The cryptocurrency and Blockchain security pioneer Ledger has secured a $7M Series A funding led by MAIF Avenir, with the participation of Xange, Wicklow Capital, GDTRE, Libertus Capital, Digital Currency Group, The Whittemore Collection, Kima Ventures, BHB Network and Nicolas Pinto. This latest investment follows a $1.5M round in 2015 and brings the total funding to $8.5M, one of the biggest Blockchain related start-up funding to date in Europe.

“Ledger has seen a tremendous growth in the last months, and we are on track to increase tenfold our revenues this year. Our primary objective is to reinforce our position as a global market leader on hardware wallet products, while we accelerate the development of enterprise cryptocurrency solutions through the signature of soon to be announced strategic partnership agreements. We are also actively pursuing research & development on hardware oracle technology with key industrial customers for smart grid, supply chain and insurance Blockchain use cases,” stated Eric Larchevêque, CEO of Ledger.

Ledger’s competitive edge is its technology: a low-footprint crypto-embedded operating system built for Secure Elements and Secure Enclaves which enables full orchestration of code and systems directly from the secure core. Ledger designs a line of products for the cryptocurrency and Blockchain market: hardware wallets for consumers, server appliances for enterprise and embedded solutions for connected objects.

“By investing in Ledger, MAIF intends to contribute to the development of the Blockchain ecosystem, a new source of confidence to record transactions, based on peer-to-peer exchanges. MAIF is proud to support Ledger into its objective to become the world leader in distributed trust,” added Jean-Marc Willmann, Deputy General Director, MAIF.

The company’s flagship products are the Ledger Nano S and the Ledger Blue, hardware wallets securing cryptocurrencies and digital identities. With more than 50,000 units sold in 130 countries, Ledger demonstrated the quality of its technology as well as its capacity to address a global consumer market.

“We are delighted to co-lead this new round of funding and renew our trust after XAnge’s seed investment in 2015. As we hear from many customers of Ledger, we believe it is one the most trustworthy teams of security experts in the world,” saidCyril Bertrand, Managing Partner at XAnge.

Next for 2017 is the launch of enterprise grade cryptocurrency security solutions (multi-signature, multi-currency, time locked payments…), targeting marketplaces, hedge funds and financial institutions.

“We believe Ledger’s hardware and software solutions will be critical to the broader adoption of Blockchain technology by both consumers and enterprises. Bringing Ledger into DCG’s global ecosystem of companies will help accelerate collaboration and innovation around security, a critical skill for any company leveraging applied cryptography or Blockchain technology,” said Barry Silbert, Founder and CEO of Digital Currency Group.

Ledger is also capitalizing on industrial Blockchain use cases with the long term objective to licence its hardware oracle technology to top players of the smart grid, supply chain and IoT security field.

“In a world that desperately need data protection, Ledger has been the first to use secure chip technology to protect data and application in a way the user can adopt. Cryptocurrencies and Blockchain applications are the ideal training ground for Ledger to expand to many other aspects of cybersecurity,” added Gabriele Domenichini, Head of Venture at BHB Network.

The new funding will be used to develop the sales, marketing, engineering and support teams through the recruitment of 20 new collaborators. It will help accelerate the launch of a new enterprise security product for cryptocurrencies, opening new lines of revenues for Ledger.

“Securing Blockchain assets such as Bitcoin and Ethereum is one of the greatest challenges in the digital asset space currently. Ledger is the leader in this field both for individuals and enterprises,” Pamir Gelenbe, Managing Partner, Libertus Capital.

Jean-Marc Willmann from MAIF joins Ledger’s Board of Directors, alongside Eric Larchevêque (CEO), Nicolas Bacca (CTO), Joël Pobeda (COO), Cyril Bertrand (Xange), Pascal Gauthier (Ex COO at Criteo and Venture Partner at Mosaic Ventures) and Frédéric Potter (CEO Netatmo).

Announcing what’s next in Ledger’s roadmap: enterprise vault

Secure cold storage of large multi-cryptocurrency funds is a difficult and complex challenge, where hardware wallets alone may not be sufficient.

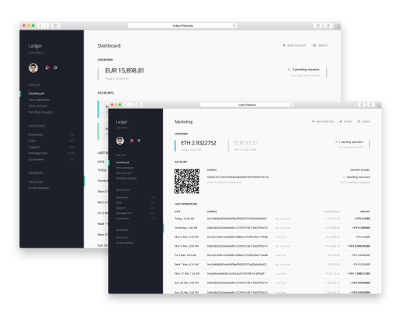

Ledger introduces an enterprise grade cold storage solution based on HSM (Hardware Security Module) and hardware authenticators. It is a turnkey SaaS hardware/software suite enabling multi-currency, multi-signature, rate limiting and time locking. The solution is fully trustless, with emergency recovery procedures available even in the case of force majeure.

There is no limit on the number of segregated accounts and cryptocurrencies managed by one entity. Each account has its own set of rules, enforced by hardware devices. For instance: a payment request must be approved by 2 administrators of a total of 3, and will be executed only after a lockup time of 72 hours (time oracle). This kind of security level reduces to the minimum the risk of internal theft as well as external physical threats (hostage situation).

Custodian service (management of one or many keys by Ledger) will also be available.

This new enterprise product launch is scheduled for Q3 2017.