Initial coin offerings (ICOs) raised USD 5.95 billion in 2017, according to Token Report’s quarterly ICO data, with 3.06 billion coming in the fourth quarter alone. When it comes to the geography of traditional venture capital deals in the United States, the San Francisco Bay Area has held king status for a while now, so it’s no surprise that it holds the crown in ICO activity as well. And while London, one of Europe’s top three VC cities, comes in third for ICOs, Moscow beats it by coming in second place.

There’s evidence that initial coin offerings may be reshaping the startup capital map. There are a few rising cities among the top ICO markets with growing amounts of deal activity that are not on traditional venture capital maps at all, including Tallinn, Estonia, and Kiev, Ukraine, to name a couple. The rapid adoption of cryptocurrency and the ease of opening a business are some factors, and in Moscow, Russia, cryptocurrency is quickly becoming a mainstream area of study at universities due to high demand.

Dollars vs. ETH & BTC

The Atlantic last year found that the U.S. is home to the top six metros and 12 of the top 20 cities with the highest levels of venture capital investment in the world. The six: San Francisco, San Jose, Boston, New York, Los Angeles and San Diego, make up 45 percent of total global investment.

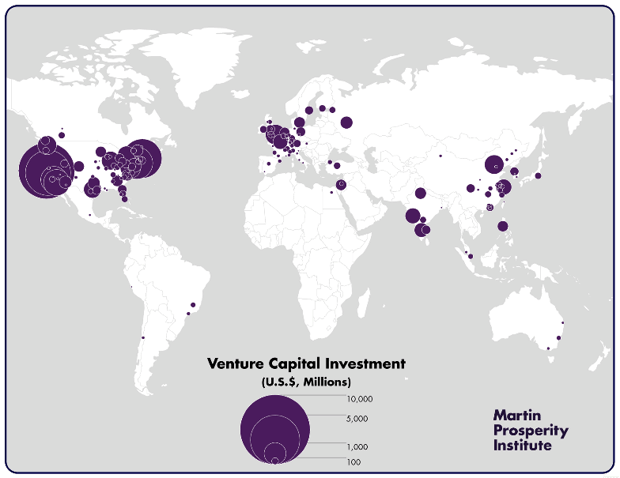

Below is a map of global tech venture capital activity, by the Martin Prosperity Institute last year, ranked by the amount of capital raised:

If you were to look at a similar heat map for ICOs, mapped by amount raised, the picture wouldn’t look too different. Of the 50 ICOs that have raised the most money to date, the majority — 18 of them — come from the U.S. Of the 18, 10 are based in the San Francisco Bay Area, one in Los Angeles, two in Seattle and only one in New York. The country in second place is Switzerland, with five ICOs, followed by Germany with four and Canada and the U.K. each with three.

But it’s important to note that it’s difficult to compare venture capital and ICOs by dollars raised, as ICO dollar amounts vary widely by market conditions as well as the value of the underlying currency it accepted as funds. For example, a project that raised 50,000 ETH in June 2017 at 300 USD per ETH is marked in our database as having raised 15 million USD — now, that amount would be worth 43.7 million USD. In addition, dollar amounts in crypto are very different from what you see in venture, where Softbank can invest billions in Uber and that’s called “venture capital.” For those reasons, we think deal activity is a more reliable indicator of an ICO cluster, for now.

ICO Deal Activity

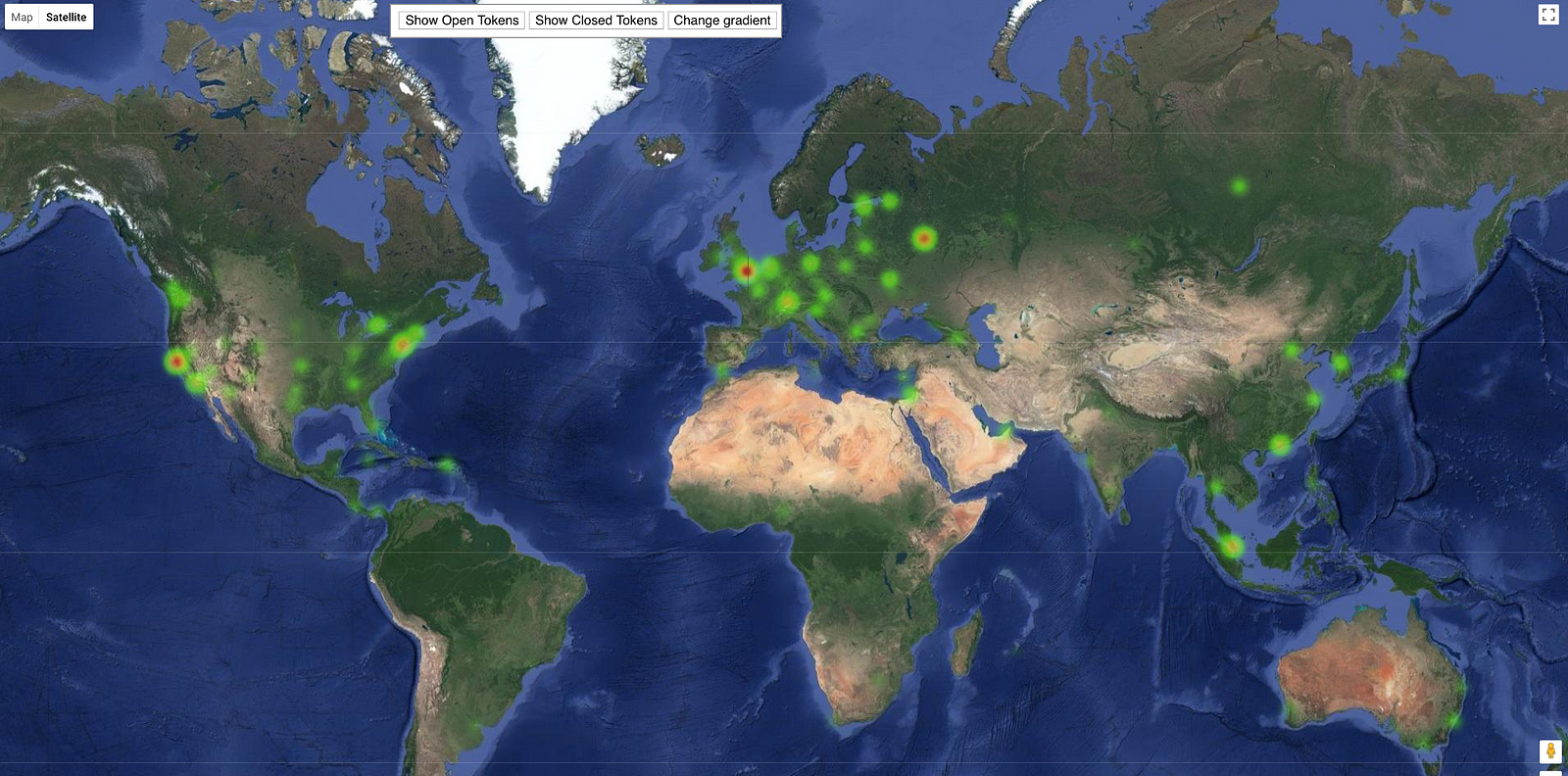

We’ve created our own heat map, viewable here, not by amount raised but of where ICOs are based. Bear in mind that the map shown below includes closed ICOs only. You can toggle the map to have it visualize open, closed or all ICOs in our database:

The metro areas on the east and west coast of the U.S. are major hotbeds of ICO deal activity. However, our data shows that after San Francisco, the only other American city in the top five is New York. Below is a list of the top 10 cities in the world that are closing the most ICOs:

- San Francisco Bay Area

- Moscow

- London

- Singapore

- New York

- Los Angeles

- Hong Kong

- Tallinn

- Berlin

- Shanghai

Surprise Honorable Mentions

The Baltic region in Europe has seen widespread cryptocurrency adoption in the last few years, including the fact that it has a high concentration of Bitcoin full nodes: Lithuania leads here, with 66 nodes — a large amount in proportion to the size of the country. Estonia as a government has been friendly to the idea of virtual currency adoption — it even proposes to issue its own Ethereum token — called estcoin — in an ICO to accelerate and facilitate investment and startup activity in the country. It currently hosts an e-residence program in which non-Estonians can register for a digital ID that allows them to start and run a European Union-based business.

Beyond that, it is relatively easy to launch a business in Estonia. Opening an LLC is cheap, and through the e-residency program virtually anyone of any nationality can launch a business. When Estonia’s e-residency program published a blog post first proposing estcoin, it saw a spike in applications to the program, mostly due to entrepreneurs hoping to easily launch an ICO.

Ljubljana, the capital of Slovenia, is frequently ranked high on lists of countries that have adopted cryptocurrency. With a population of just 279,796, in 2015 it already had 51 merchants accepting bitcoin and a couple of ATMs. The exchange Bitstamp is headquartered there, and notable ICOs to have closed in the city include Iconomi, Quantum, Cofound.it and Viberate.

Token Report, a financial data service for cryptocurrency investors, has merged with Blockchain News. This article originally appeared on Token Report’s blog.