Visa has just announced a preview of Visa B2B Connect, a new platform that Visa is developing with Blockchain startup Chain to give financial institutions a simple, fast and secure way to process business-to-business payments globally.

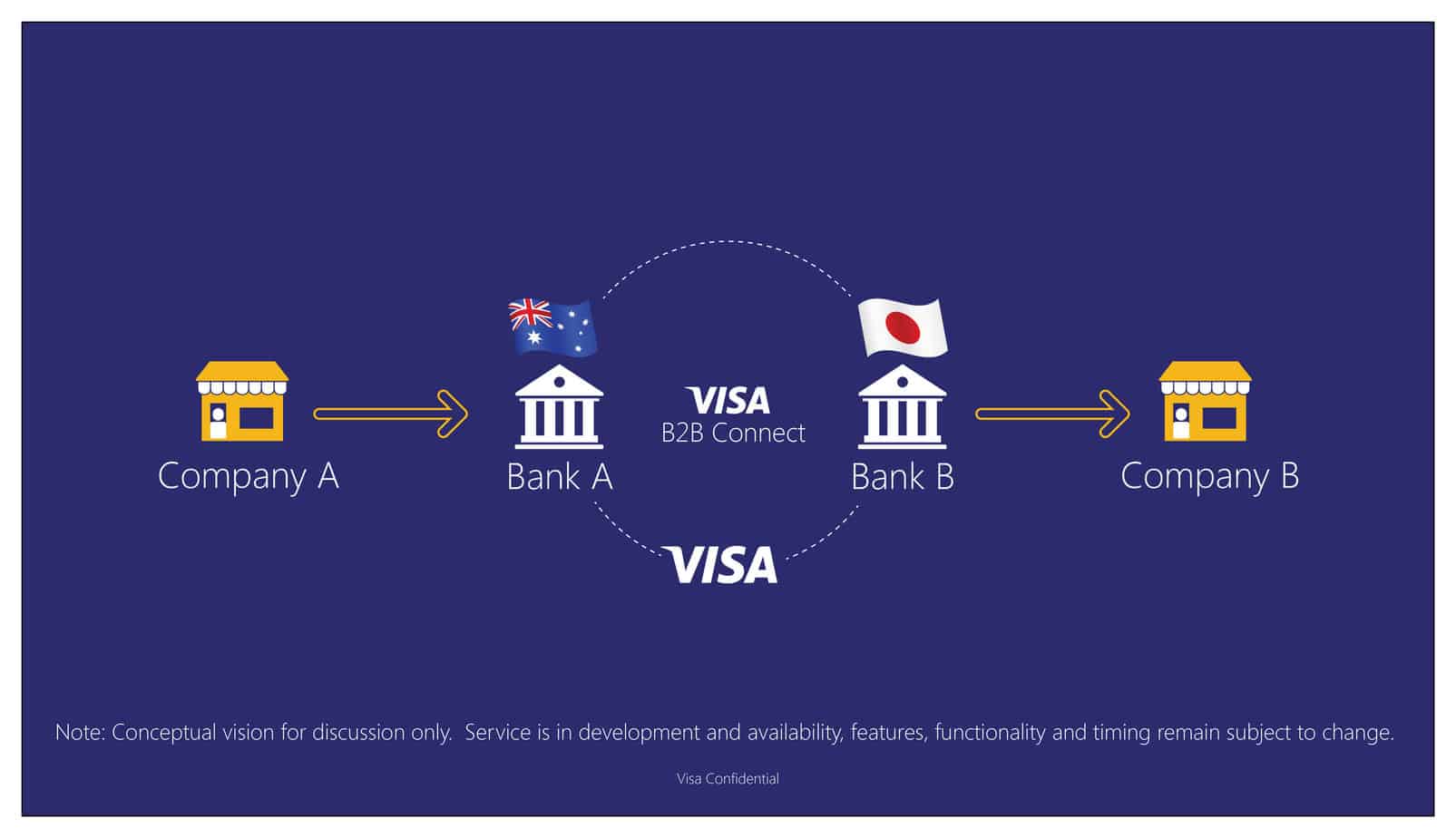

Visa is working to build Visa B2B Connect using Chain Core, an enterprise Blockchain infrastructure that facilitates financial transactions on scalable, private Blockchain networks. Building on this technology, Visa is developing a new near real-time transaction system designed for the exchange of high-value international payments between participating banks on behalf of their corporate clients. Managed by Visa end-to-end, Visa B2B Connect will facilitate a consistent process to manage settlement through Visa’s standard practices.

“The time has never been better for the global business community to take advantage of new payment technologies and improve some of the most fundamental processes needed to run their businesses,” said Jim McCarthy, executive vice president, innovation and strategic partnerships, Visa Inc. “We are developing our new solution to give our financial institution partners an efficient, transparent way for payments to be made across the world.”

“This is an exciting milestone in our partnership with Visa,” said Adam Ludwin, chief executive officer of Chain. “We are privileged to support Visa’s efforts to enhance the service it provides to its clients and shape the future of international commerce with this Blockchain-enabled innovation – streamlining business payments among financial institutions and their customers around the world.”

With Visa B2B Connect, Visa aims to significantly improve the way international B2B payments are made today by offering clear costs, improved delivery time and visibility into the transaction process – ultimately reducing the investment and resources required by banks and their corporate clients to send and receive business payments.

Visa B2B Connect, which Visa plans to pilot in 2017, is designed to improve B2B payments by providing a system that is:

- Predictable and transparent: Banks and their corporate clients receive near real-time notification and finality of payment

- Secure: Signed and cryptographically linked transactions are designed to ensure an immutable system of record

- Trusted: All parties in the network are known participants on a permissioned private Blockchain architecture that is operated by Visa

For more information, please contact visab2bconnect@visa.com.

Visa is a global payments technology company that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. We operate one of the world’s most advanced processing networks — VisaNet — that is capable of handling more than 65,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead with prepaid or pay later with credit products. For more information, visit usa.visa.com/about-visa, visacorporate.tumblr.com and @VisaNews.

Chain (www.chain.com) is a technology company that partners with leading organizations to build, deploy, and operate Blockchain networks that enable breakthrough financial products and services. Chain is the author of the Chain Protocol, which powers the award-winning Chain Core Blockchain platform. Chain was founded in 2014 and has raised over $40 million in funding from Khosla Ventures, RRE Ventures, and strategic partners including Capital One, Citigroup, Fiserv, Nasdaq, Orange, and Visa. Chain is headquartered in San Francisco, CA.