On Thursday, June 22, at 2pm GMT, the world’s first Smart Token, BNT, was activated.

For the first time in history, an ever-liquid token has been deployed live in the field. BNT can always be purchased simply by sending ETH to an address — which instantly issues BNT tokens back to the sender, according to its current price, per the formulas in the Bancor protocol white paper. Liquidating BNT to ETH is always possible as well, through popular Ethereum clients. This is still a multi-step process, but it works.

A quick reminder on the Bancor protocol smart token mechanics: The price (and supply) of a smart token increases whenever the token is purchased, and decreases whenever it’s sold, and in both cases relative to the transaction size (meaning bigger increases or decreases for larger transactions in either direction), in order to maintain an exact 10% (or the relevant user-configured CRR) reserve ratio. The available reserve of of BNT is always 10% of its market cap, and in BNT’s case, held in ETH. Tens of millions of dollars worth of ETH have already been deposited into and removed from the BNT reserve, directly through the smart token contract itself, allowing people to increase or decrease their BNT holdings, without dependence on buyers and sellers in any exchange. This is historic, and the implications will reverberate far into the future.

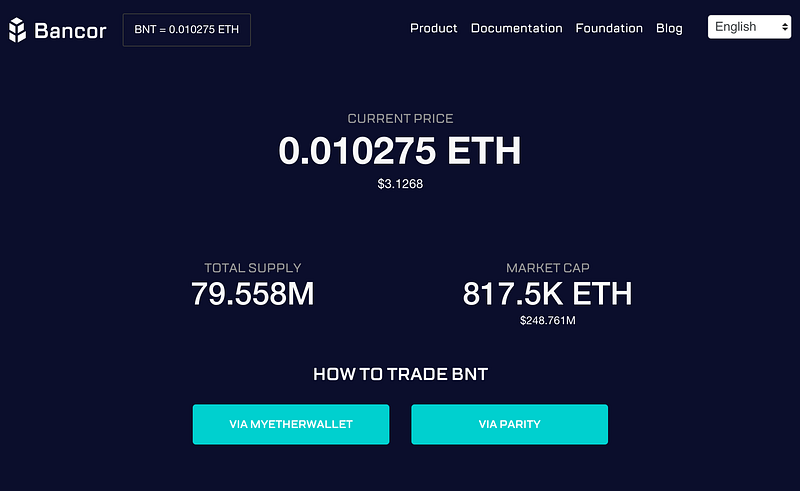

This novel pricing model is based solely on actions (buys/sells), and requires no speculation in the price discovery process (bids/asks). There is no spread (meaning the unit buy/sell price is identical), and the slippage is known and predictable for any transaction size. Until we launch our full alpha which will make all smart token actions dead simple, holding, purchasing and liquidating BNT (w/price limits) can be done with popular Ethereum clients such as MyEtherWallet and Parity. BNT is also supported in imToken, which has an awesome user experience and can be used with our simple BNT purchase address. BNT has been listed and traded on Bittrex and Liqui, and has been added to the Changelly instant exchange. It will go live on other exchanges throughout this week as well.

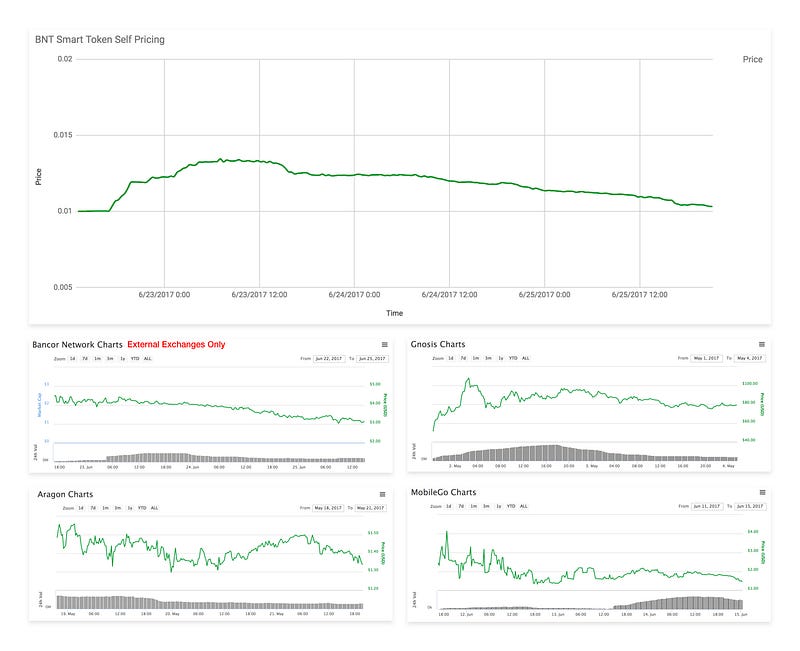

Watching the different markets, it is apparent that the smart token indeed provides a price anchor across exchanges (through arbitrage), and reduces its own volatility (through the reserve). Below we compare the post-TGE price charts of popular token sales:

In most, we see an initial price rise, seemingly generated by those who missed out on the TGE or heard the buzz about its success and are buying from the limited supply on exchanges. Next, a pronounced crash, as many look to cash out their fast (often few hour) profits and move on to the next TGE to repeat, while no product value has yet been generated to offset these sells. With BNT, we see this same early rise, but from users sending ETH directly to its contract. And we’ve seen sells, which apply downward pressure on price, likely from short-term contributors cashing out their immediate profits. Yet both the rise and fall are smoother than anything we’ve ever seen.

To us, this data is incredible, as it demonstrates one of the main objectives behind the Bancor protocol, which is to achieve relative stability, which we believe is ultimately healthier for real usage, by real people, in real communities. The spikes and crashes generated by hyped launch events are only good for speculators who ride wave to wave, often based on insider info, large pre-sale volume discounts, and market making abilities. Many of these contributor profiles exist within the Bancor community as well, and it is their prerogative to sell BNT as they realize that this token indeed does behave exactly as promised: steadily and algorithmically rising and falling with buys and sells, unrestricted by artificial supply limitations, and ultimately dependent on real usage to create real value. Long term, we think actual buys and sells from a central (while decentralized) automated liquidity pool (“reserve”) with adjustable token supply are a better measure for a token’s price than bid/ask sentiment alone, spread among for-profit market makers with a fixed token supply. In other words, the reserve of a smart token functions as a shared liquidity pool, comparable to the market depth in the order book of an exchange.

We are monitoring BNT closely to ensure that everything works as expected. While we understand the public is anxious when price declines (and the model here is new and requires some understanding), we are more focused on the mechanics and the code, ensuring that the foundation is firmly in place to grow the Bancor project over decades. If speculators and immediate profit seekers are unwinding their positions, applying downward pressure on the price, they are making room for those who still wish to enter at early contributor levels and support the project from the ground up. We are committed to our pilot price floor, which ensures that early BNT contributors will be able to sell for no less than they bought (up to ~120k ETH), and have already deployed this automatic smart contract and are currently testing it in case it is needed. This is also revolutionary in the nascent token space, and we hope it’s comforting at these early stages when the project is taking root. Our hope was that this mechanism would prevent panic in the classic sense of “if I don’t sell now I’m going to lose everything,” and to give the actual fundamentals a chance to develop.

Our efforts in the coming days and weeks are around sharing with the community new advisers to the project, new partnerships that will demonstrate the reach and functionality of smart tokens, and new community initiatives that will begin to actualize the spreading of smart tokens in exciting ecosystems and brands. These developments have been in the works for months and new ones are continuously in process. On the technical side, we are working on a more simplified BNT sell contract, auditing our automatic price floor contract, improving the BNT stats page on our website, and of course continuing to build the front-end application as per our extensive (and commentable!) roadmap. We are also gearing up the Bancor organization to enter its post-TGE formation, including best-in-class internal and external brains to take on regional and functional verticals, so its an exciting and busy time all around. We hope you’ll stay with us to watch it all unfold, as we keep our eyes on the real prize: a sustainable platform for user-generated tokens that work.

Originally published on the Bancor Blog.