In cryptocurrency right now, the only value investors are the Bitcoin maximalists.

That’s hyperbole, but it’s true that momentum rules this market.

“My investment thesis is very short-term for ICOs (1-12 months) and purely hype based, not merit based,” a friend told me candidly yesterday. I’ve heard similar talk from many sophisticated investors.

In a market with cynical momentum investors on one side, and dozens of new shitcoins served up weekly, it would be easy to get disillusioned. It would be easy to doubt a long-term vision in which there are thousands of cryptocurrencies, traded and valued in all corners of the globe.

That’s a vision of the future that Token Report was founded on and believes in. How to research ICOs and tokens? To sift through the tide of bullshit today, you need a good sniff test that can quickly reject the projects that lack credibility or momentum.

Here’s mine, distilled into seven questions. The first four are momentum-related, for the investor who wants a short-term buy that doesn’t insult anyone’s intelligence. If momentum is all you care about, stop there. If you’re looking for a value investment, good on you: continue to the final three. As always, this isn’t investment advice–just my opinion.

Did I miss anything that’s important to you? Let me know in the comments, or join our Telegram forum to discuss your token-picking strategy: http://t.me/tokenreport.

7 Must-Ask Questions for Crypto Investors

- Who are the token issuers marketing to? Investors or users? Follow the call-to-action: Does it give confidence they can capture a market of users? Or are they better at capturing FOMO-bound crypto-n00bs?

- Is the core team credible? Do you believe they will have an unfair advantage in their market, based on their credentials, their connections and their past projects? Is their road map credible?

- Is the network gaining momentum? I.e., am I impressed by the people and the conversation in the forum–either by its volume, by its content, or both?

- What are the terms of the issuance? Total supply, price, float and contribution limits: based on what you learned about the network’s momentum, are they structured to strike the right balance between supply and demand? Can you foresee a population of crowdsale buyers who couldn’t get into the ICO, creating demand on exchanges?

- Is there value underlying the speculation in the token? I.e., does the network have something the user needs? Does the user have something the network needs? A product, prototype or demo helps evaluate this.

- What does the token do that cash, or another cryptocurrency, cannot?

- Who are the competitors? Are there competing projects offering a token? What are the competitor incumbents, with or without tokens?

Update: For an example of how I apply these questions, take a look at this week’s ICO pick, Bee Token, and our analysis of /BEE.

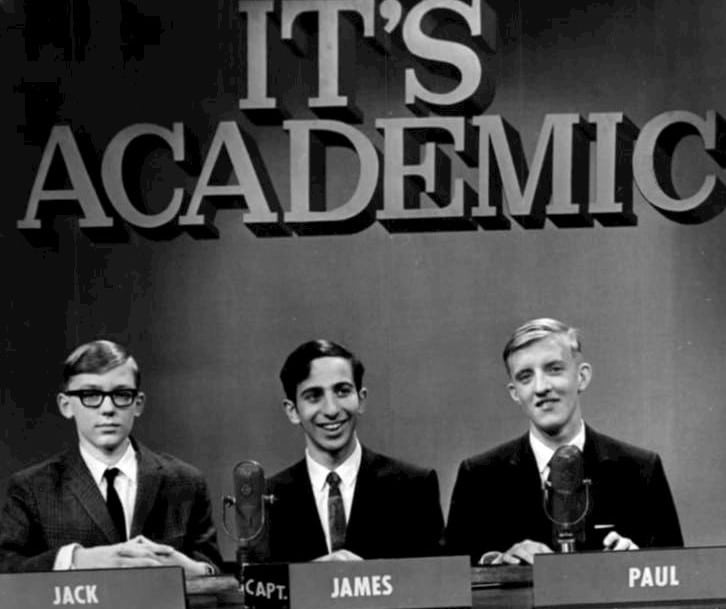

Photo of the It’s Academic game show in 1967 via public domain.