Bitcoin has once again proved its resilience as it surged over 20% and hit above $5,000, a level not seen since November 2018. However, the sudden surge has left the market questioning the move and the reasons behind it, particularly given the lack of any major news or development.

As per our research and discussions with data analysts, it appears that the move was kickstarted by a relatively large OTC order, who most likely contacted several OTC desks, which in turn executed the trades. Once the price started climbing, fund managers who follow momentum also jumped in, as well as retail investors.

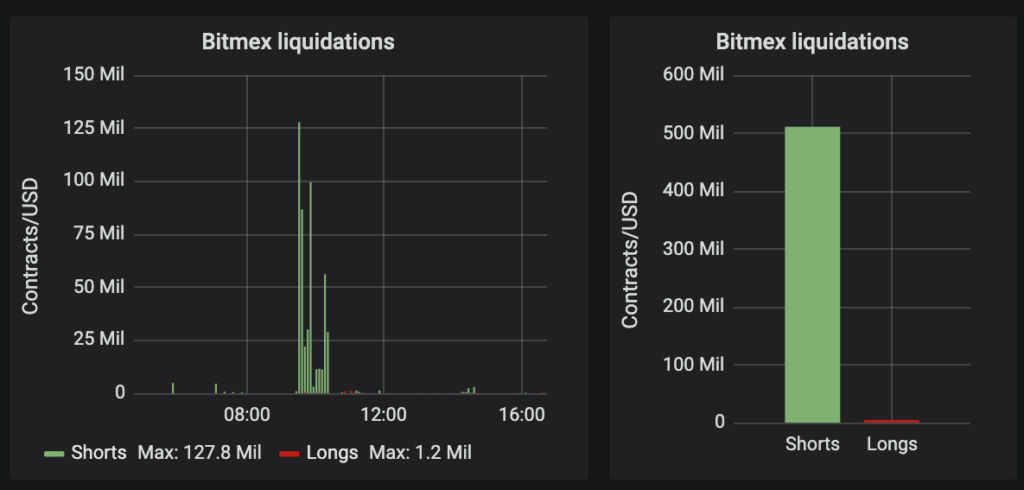

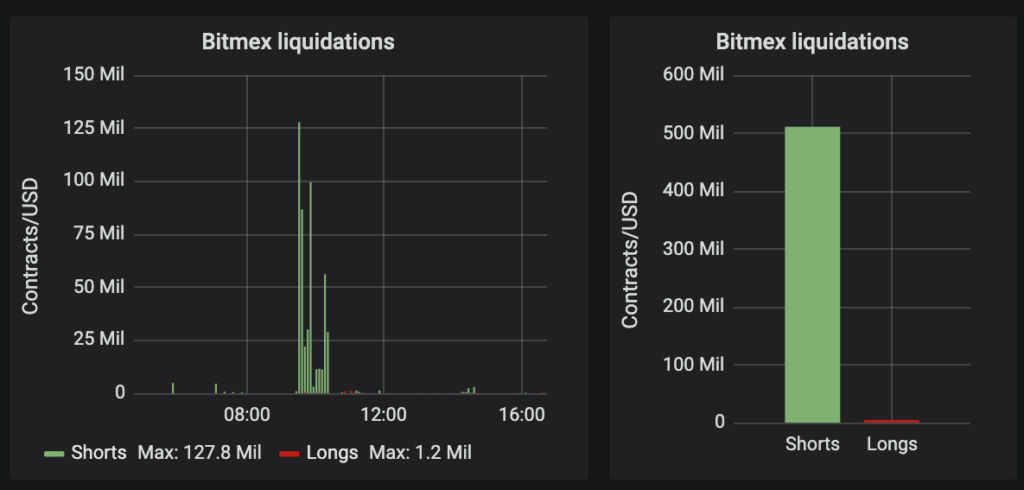

Moreover, the price movement also liquidated over $500M worth of shorts at Bitmex alone, which also resulted in a short squeeze and gave the market another push.

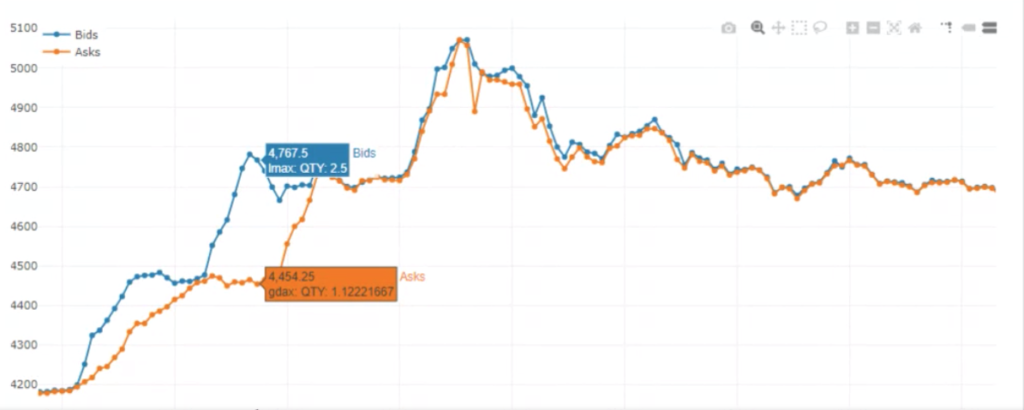

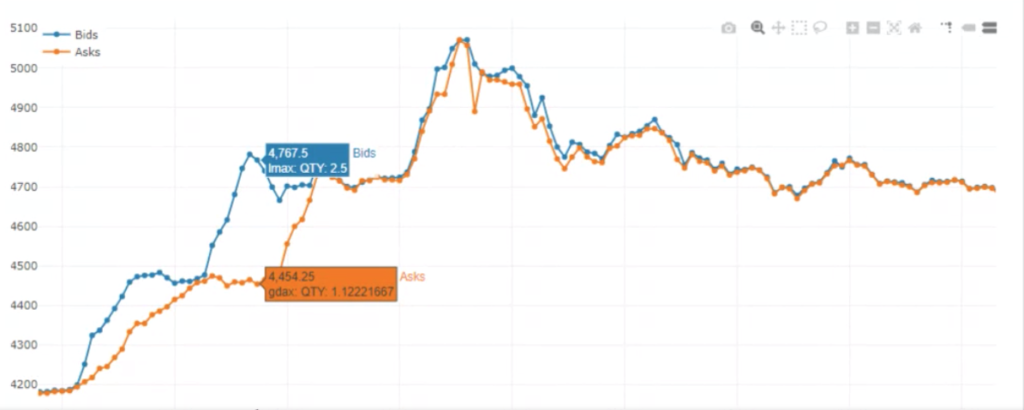

The chart below reflects this behavior, where the blue line (showing bids) and the orange line (showing asks) display a rather large difference (roughly $300), where buys were made at significantly higher prices than what was being asked at most exchanges.

Data from CoinRoutes

Soon afterward we see the lines merge, which shows normal trading behavior as bids and asks match closely. However the surge from $4,200 to $4,800 was markedly curious and corresponds with a large order placed concurrently via multiple OTC desks.

The chart below shows $500M worth of shorts being liquidated on Bitmex on over April 2, 2019. Shorts are bets on the price going down, but instead, when it rises, short sellers are liquidated as their margins are reached and they scramble to buy the underlying asset (in this case Bitcoin) before their losses increase. This liquidation of shorts followed by buying orders further pushes the price higher in what is called a short squeeze.

Now that we are at this price point, however, the question is whether this marks the end of the bear market and the start of a new bull run? At BitBull Capital we have long maintained our $5,000 target for Bitcoin, and we are getting close to it. This month’s surge, though dramatic, was expected, because our recent analysis (shared with our investors late March) showed a stable, and steadily rising trend in Bitcoin trading volumes and price, which was a marked difference from BTC price movements over the last 3 months (chart below shows the steady rise from early February to late March – right before the current jump).

However, we do not believe that the current price action conclusively marks the beginning of a new bull run. The most recent surge should be considered cautiously, and the market is likely to witness a few corrections and further attempts at the $5,000 price point in the coming days.

If Bitcoin manages to retain most of its recent gains throughout the month and consolidates around the $4,600 – $4,850 range, we can expect a breakout over $5,000 and a possible move higher. Till then, we can expect altcoins to surge sporadically as profits from Bitcoin flow into other digital currencies.

As per our research and discussions with data analysts, it appears that the move was kickstarted by a relatively large OTC order, who most likely contacted several OTC desks, which in turn executed the trades. Once the price started climbing, fund managers who follow momentum also jumped in, as well as retail investors.

Moreover, the price movement also liquidated over $500M worth of shorts at Bitmex alone, which also resulted in a short squeeze and gave the market another push.

The chart below reflects this behavior, where the blue line (showing bids) and the orange line (showing asks) display a rather large difference (roughly $300), where buys were made at significantly higher prices than what was being asked at most exchanges.

Data from CoinRoutes

Soon afterward we see the lines merge, which shows normal trading behavior as bids and asks match closely. However the surge from $4,200 to $4,800 was markedly curious and corresponds with a large order placed concurrently via multiple OTC desks.

The chart below shows $500M worth of shorts being liquidated on Bitmex on over April 2, 2019. Shorts are bets on the price going down, but instead, when it rises, short sellers are liquidated as their margins are reached and they scramble to buy the underlying asset (in this case Bitcoin) before their losses increase. This liquidation of shorts followed by buying orders further pushes the price higher in what is called a short squeeze.

Now that we are at this price point, however, the question is whether this marks the end of the bear market and the start of a new bull run? At BitBull Capital we have long maintained our $5,000 target for Bitcoin, and we are getting close to it. This month’s surge, though dramatic, was expected, because our recent analysis (shared with our investors late March) showed a stable, and steadily rising trend in Bitcoin trading volumes and price, which was a marked difference from BTC price movements over the last 3 months (chart below shows the steady rise from early February to late March – right before the current jump).

However, we do not believe that the current price action conclusively marks the beginning of a new bull run. The most recent surge should be considered cautiously, and the market is likely to witness a few corrections and further attempts at the $5,000 price point in the coming days.

If Bitcoin manages to retain most of its recent gains throughout the month and consolidates around the $4,600 – $4,850 range, we can expect a breakout over $5,000 and a possible move higher. Till then, we can expect altcoins to surge sporadically as profits from Bitcoin flow into other digital currencies.