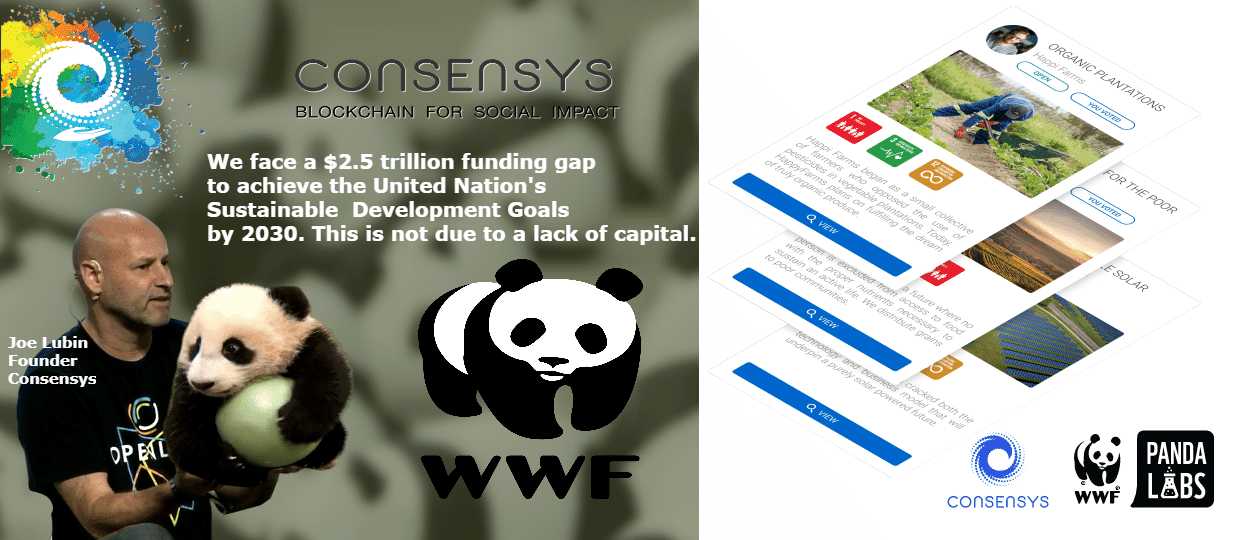

ConsenSys Social Impact has teamed up with the WWF, to develop a new project called Impactio – a project curation and funding platform which utilizes Ethereum blockchain technology and tokenization to maximize collaboration between subject-matter experts and individuals or organizations to bring social impact projects to life.

Impactio – an exciting & new approach to project incubation, selection & funding while leveraging the#Ethereum#blockchain.

Impactio has been developed in partnership by@WWF Panda Labs 🐼 and@ConsenSyshttps://t.co/OqDq7SmfbCpic.twitter.com/V1X3iV0IWy

— ConsenSys (@ConsenSys)September 24, 2019

Here’s how Impactio works to fix that:

Individuals or organizations submit their projects with clear objectives for issues ranging from sustainability and inequality to emerging communities and the environment. The process starts off with project leaders submitting their projects based on the UN’s 17 Sustainable Development Goals (SDGs).

A global network of curators who are subject-matter experts are issued Impactio Tokens that are held in a digital wallet, and the platform uses a system inspired by ConsenSys’ research on Token Curated Registry (TCR) to curate a list of high-impact, high-potential projects to present to potential funders.

A global network of curators who are subject-matter experts are issued Impactio Tokens that are held in a digital wallet, and the platform uses a system inspired by ConsenSys’ research on Token Curated Registry (TCR) to curate a list of high-impact, high-potential projects to present to potential funders.

Curators are then encouraged to provide constructive feedback on the platform for project leaders. Project leaders can use this to fine-tune their projects, while their causes stand a higher chance to come to fruition. This openness and access to expertise is invaluable and is arguably the most compelling feature of the platform and its workflow.

Once curators have reviewed the projects with the project leaders and their peers, it is critical at this stage for decisions to be made objectively and allows for all curators to have a say. This is where a TCR — a Token Curated Registry — enters the process. It requires curators to stake their tokens to back a project, and for curators who wish to dispute that project to stake the same amount of tokens. If there are no other curators who object to the project, the project will be approved and surfaced for donors to decide on funding. If there are objections, curators can challenge the project by matching the tokens staked by the curator backing the project. Subsequently, the other curators will assess the merits of the project and vote to resolve the challenge. Projects will either be approved or declined depending on the votes.

“The imperative is clear: put the projects on the table. The capital will follow,” stated Julie Fetherstone, from Boston Consulting Group, Centre for Impact. “What is lacking is a robust mechanism for linking these private dollars to viable, large-scale, SDG-advancing projects.”

According to Robby Greenfield, Co-founder at ConsenSys Social Impact:

“This is a problem for both companies and individuals that want to fund social impact projects and nonprofits.”

“Just like most companies, projects within NGOs and standalone projects compete with one another for funding. And the result is that they will only have the resources to assess and focus on a few. This will lead to good projects falling through the cracks. This is even more apparent for projects that aren’t part of a funding network and these nonprofits spend a lot of time producing the same work to pitch their ideas to funders. The other problem is how these projects are assessed and greatly they vary.

“Many nonprofits struggle to show that they are using their funds effectively and how it aligns their funders’ goals,” Greenfield explains. “In fact, law firmNolo reported that, in a study of over 220,000 nonprofits, researchers concluded that 75% to 85% of these nonprofits were improperly allocating their expenses.”

If a project is approved by voting consensus, the curator backing the project will have their staked tokens refunded and receive additional tokens as a reward for investing their time and commitment in backing a project. Fellow curators who voted for the approved project will also receive tokens as a reward for their due diligence in assessing and resolving a challenge. The rewards are paid from the stake of the curator that challenged the project, a key measure to disincentivize unmotivated and unreasonable challenges.

If a project is declined by voting consensus, the challenger receives their staked tokens and reward tokens, and the curator backing the project loses their staked tokens. This mechanism ensures only worthy projects are backed and ultimately surfaced to donors. This will all lead to philanthropists, investors, and donors having more confidence that the selected projects would have undergone a rigorous peer-review process by subject-matter experts from around the world, with good governance in place and can decide to fund them.

The curation process to develop a list only takes up to 6 weeks. Overall, Impactio creates a positive network effect through consensus objective-decision making, where experts perform due diligence collaboratively and donors feel confident in supporting approved projects. There is increasing evidence that platforms like Impactio are severely in need. The Economic and Social Commission for Asia and the Pacific (ESCAP)’s latest Sustainable Development Goals Progress Report shows that the Asia Pacific region is on course to miss all its Sustainable Development Goals. According to the Centre for Public Impact, there are too few visionary and transformative projects being conceived and offered to large investors globally. Without these projects to drive investment, the annual gap of USD2.5 trillion to meet SDGs will not be closed.

The curation process to develop a list only takes up to 6 weeks. Overall, Impactio creates a positive network effect through consensus objective-decision making, where experts perform due diligence collaboratively and donors feel confident in supporting approved projects. There is increasing evidence that platforms like Impactio are severely in need. The Economic and Social Commission for Asia and the Pacific (ESCAP)’s latest Sustainable Development Goals Progress Report shows that the Asia Pacific region is on course to miss all its Sustainable Development Goals. According to the Centre for Public Impact, there are too few visionary and transformative projects being conceived and offered to large investors globally. Without these projects to drive investment, the annual gap of USD2.5 trillion to meet SDGs will not be closed.

Being socially responsible is no longer an option for companies — it’s a must. In 2017, donations to charity reached an all time high in the US, with an estimated $410 billion USD donated to various causes by groups and individuals. Similar trends are evident all over the world, including Australia, where the 50-largest ASX-listed companies donated a total of $867 million to community causes during 2017. As we hand the baton to a new generation that will lead investor and consumer markets, the standards that companies must uphold have become markedly higher.

According to the Millennial Impact Report, 90% of millennials interviewed planned to give to 5 nonprofits or more. And this was in 2015! Millenials are also expecting much more when it comes to transparency and accountability. They grew up in the era of social media and messaging, where everything is shared and interconnected. They want to be engaged, and they want to see their actions influence change.

Millennials also take this mentality into the workplace as they become the decision-makers that determine how their companies will spend funds on the right social impact projects. Making these decisions is a real challenge.

DFIs (development finance institutions) like yours, with expertise, connections and passion in abundance, can step boldly into the void, aligning with national external partners to identify the best projects and marketing them to institutional investors.

To discuss partnerships, funding, and investment opportunities, please contact info@impactio.global.