Crypto analyst Ali has the potential for DOGE to rise by at least 6,770%. In a social media X post on December 30, Ali pointed out that if DOGE continues to occupy the ongoing ascending parallel channel pattern, then such a jump is possible.

The forecast comes as Dogecoin is still at $0.3215 after some volatility to rebound from a high of $0.50 earlier this year. Essential technical characteristics together with prices help build a favorable buying zone at $ 0.30 while selling at $ 0.35 $ to $ 0.40.

Technical Analysis Shows Possible Points of Support and Resistance for DOGE

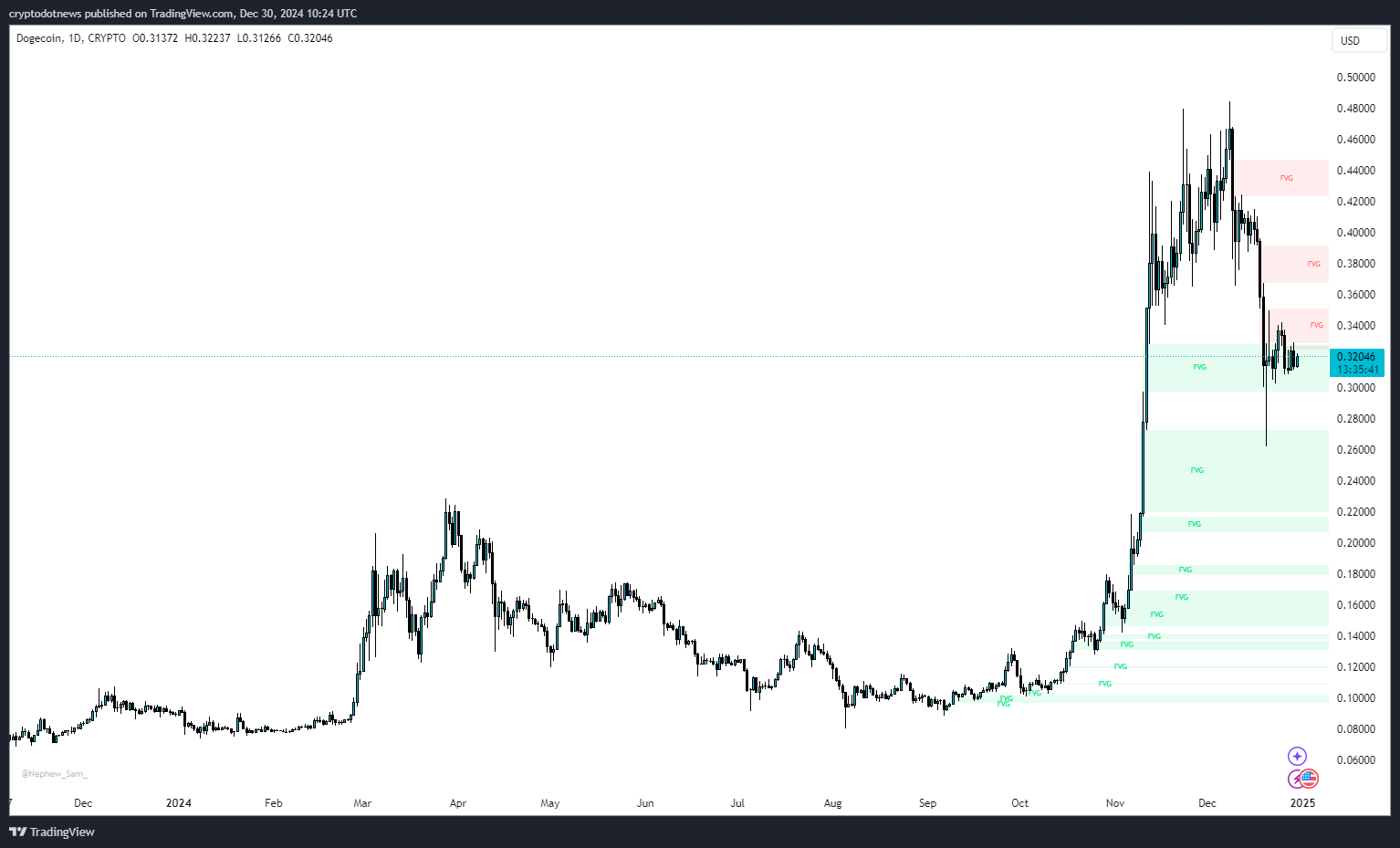

Dogecoin has oscillated in a range of $0.30- $0.32 which gives it more room to swing in the future. Calculation shows that the basic support is $0.30 while the resistance has been seen around $0.40. These zones relate to regions with past FVG, and established areas of missing market liquidity.

The D/O ratio rose as DOGE faced selling pressure near the $0.45 resistance line to halt its rising price in the past week. A breakout above the $0.40 resistance will open the path for a better bounce back while open downsides are seen at the level where unfilled liquidations are observed below $0.30.

The bearish concoction that currently pervades all markets calls for caution among investors.

MACD, as well as other technical signs, give bearish signals for Dogecoin. We have seen a bearish crossover where the MACD line is below the signal line of the MACD chart. This has been coupled with the selling pressure as illustrated by the lengthened red bars on the histogram.

This is consistent with the token’s recent failure to maintain its price above $0.35 in the last couple of weeks. From the MACD, it can be seen that bears have been in control lately specifically after the decline from the November highs.

Market Sentiment and Market States Affect DOGE

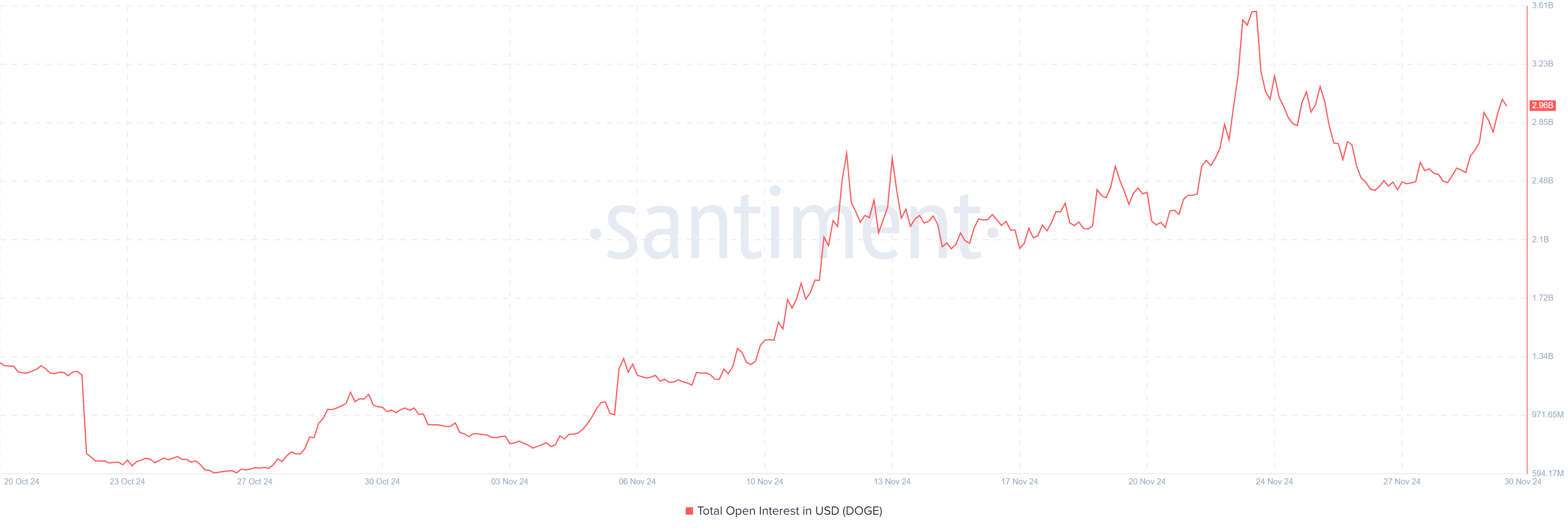

The market sentiment of Dogecoin is still less clear, and its price is unpredictable due to the worldwide shift in the economy and overall crypto trading environment. As valiantly supported as DOGE is, it has its limitations it falls within the category of speculative currencies and relies heavily on open interest data.

According to open interest data from Coinglass the range between October and November 2024 with the open interest rising and reaching a height in mid-November before coming back to around 2.96 billion dollars. This suggests that there is further speculative activity going on but this constant market engagement is required to sustain a bullish run.

Outlook for Dogecoin

To hit the predicted 6,770% rally, Dogecoin must maintain the ascending parallel channel pattern and break out the critical resistance levels. A breakout above $0.40 and $0.50 could start a new bullish wave. However, these big liquidity gaps below $0.30 point to a possible danger to the cryptocurrency in the future.

As the general crypto market becomes more stable, so will the fluctuations in Dogecoin’s price more frequently be observed by investors and researchers.