Bitcoin’s price is under pressure as it approaches a death cross pattern, mirroring trends in the S&P 500 and Nasdaq. Investors are closely watching whether BTC will drop below $80,000 amid ongoing market volatility. With the US Personal Consumption Expenditures (PCE) data indicating persistent inflation, traders are bracing for a further downside in equities and crypto markets.

Bitcoin, S&P 500, and Nasdaq Form Death Cross

Bitcoin follows the same pattern as traditional markets primarily through its relation with the S&P 500 and Nasdaq indexes. The technical indicator known as a death cross shows up in three indices according to Barchart data as their 50-day moving average tumbles beneath the 200-day moving average. Market research shows this indicator predicts extensive price decreases are likely to happen.

The S&P 500 suffered a $2 trillion loss in investor wealth over the past week. Following Friday’s market close, S&P 500 futures plunged by another $120 billion, adding to investor concerns, as per The Kobeissi Letter. Bitcoin has also struggled to maintain its recent rally, facing strong rejection at $89,000 before slipping toward the $81,500 range. Market analysts are monitoring whether BTC will continue downward to test the $80,000 psychological level.

Bitcoin’s Digital Gold Narrative Challenged

As Bitcoin and equities decline, gold has reached new record highs, surpassing $3,090. Economist Peter Schiff, a long-time Bitcoin critic, highlighted the divergence, stating, “Gold is above $3,090 for the first time, with a new record high of $3,097. In contrast, risk assets like stocks and Bitcoin are selling off again. If you still think Bitcoin is digital gold, think again.”

Bitcoin has often been compared to gold as a hedge against inflation. However, the recent downturn challenges this narrative as investors continue moving capital into traditional safe-haven assets instead of cryptocurrencies.

Bitcoin Miners Sell Amid Liquidity Concerns

Crypto analyst Ali Martinez said that Bitcoin miners have conducted major BTC asset sales. The Bitcoin mining sector sold over 2,400 BTC worth $220 million through their operations during the preceding week. Market forces initiated by Bitcoin miner selling have hurt its price and reduced overall buying power.

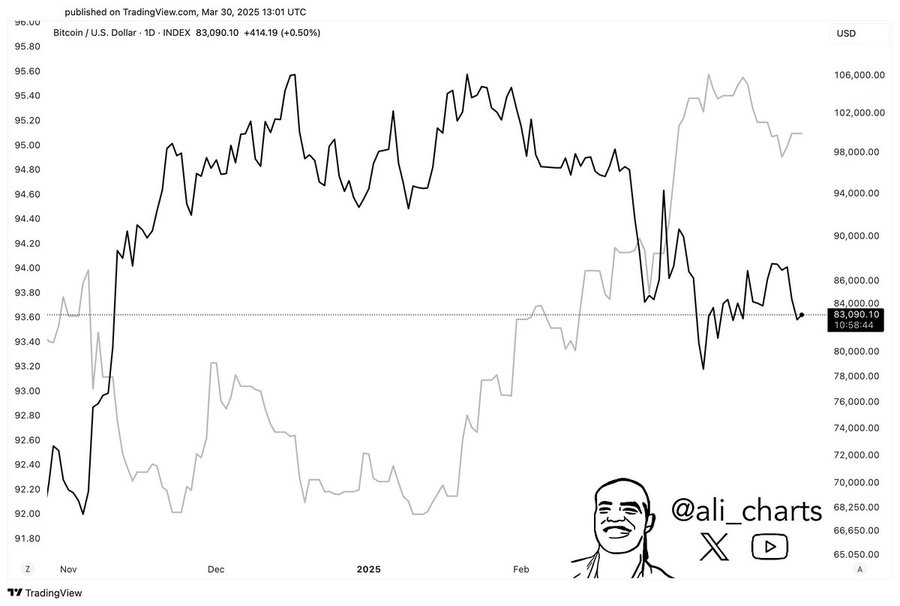

According to Ali Martinez, throughout the past two weeks the worldwide money supply shrank by $1 trillion. Analysis shows that Bitcoin price movements have historically tracked how much money expands or contracts within financial systems; thus, many experts wonder if additional contraction could produce a prolonged Bitcoin market decline.

US PCE Data and Market Sentiment

U.S. PCE statistics showed ongoing inflation, which weakened the possibility of swift Federal Reserve interest rate reductions. The recent data caused Bitcoin’s price to decline and trading markets throughout the board to show adverse reactions as traders expect a prolonged tightening of monetary policies.

Bitcoin trading stands at $81,64 as it reveals a 1.8% decrease during the last day. Btc futures open interest experienced a decline of 2.7%, which dropped its value to below $53 billion. This is a total 24-hour liquidation that exceeded $64 million, but long liquidations amounted to $54 million.

Bitcoin together with the S&P 500 and Nasdaq index, is expected to experience ongoing market volatility because they approach their death cross points. The market will closely observe whether BTC succeeds in maintaining its position above $80,000 or shows signs of continued decline.

[…] for users to create a Mastercard username which facilitates peer-to-peer transactions through Bitcoin and other […]

[…] or continuation of the previous trend. According to Ali_Charts, a 15% price move could occur once Bitcoin exits the triangle consolidation […]