Hadrien Charlanes, a decentralized app developer from ConsenSys has just announced in a Blog post at Medium that he is launching StabL, a Blockchain company that aims to operate on-chain derivative markets (Futures/Contracts For Differences-based products) and develop an ecosystem of traders, individuals, and decentralized applications that benefit from these new financial markets.

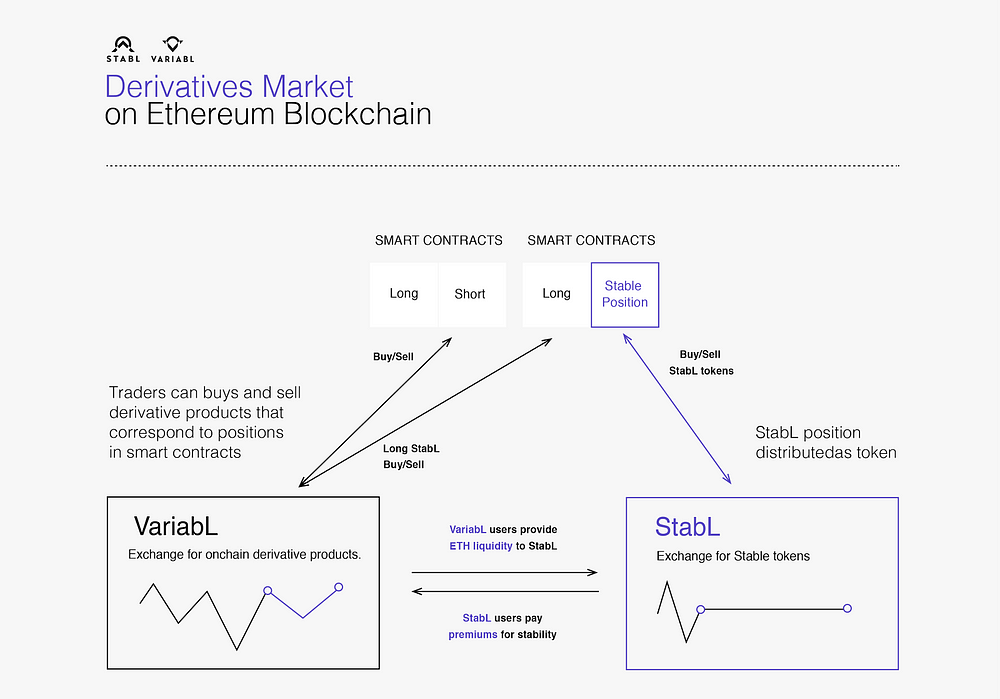

We will mainly distribute these derivative products through our semi-decentralized exchange, VariabL. Some of our financial products will have the property of remaining stable against the price of fiat currencies such as USD, EUR, CNY or JPY. We will distribute these positions as USD/EUR/CNY/JPY StabL tokens on a more user-friendly exchange, StabL. Ultimately, StabL seeks to the step of exposure to ether from people who wish to interact with the Ethereum network.

VariabL will enable traders to benefit from low cost, yet highly secure, financial products while StabL will offer dApps and individuals access to stable values on the Blockchain.

Stable tokens have been a leading topic of discussion since the birth of Ethereum. Using the decentralized platform that is the public Ethereum necessitates holding ether, not only to use it as gas or fuel, to gain access to the shared public resource of the mainnet but also as a currency to store value. The problem with using ether as a currency, is that it is a currency whose price is variable. If this risk obstacle of volatile price were overcome, with the introduction of a cryptographic asset that tracks, for example, to USD, it would pave the way for massive acceleration of Ethereum adoption.

We expect to sustain the same kind of virtuous circle that happens between Coinbase cryptocurrency users and GDAX crypto-traders. StabL users (individuals and apps built on Ethereum) will have access to StabL tokens when they need it, benefiting from the liquidity provided by VariabL, while traders on VariabL (market makers) will benefit from premiums generated by StabL users who are ready to pay for a service: stability.

The first step for Stabl will be to attract a critical mass on VariabL the exchange they plan to demo at EdCon in Paris and release in alpha in the coming month.

Stable tokens: What’s at stake?

A Stable token is a crypto-token that keeps a stable value against a specific index like the price of one US Dollar.

A crypto-token is a transferable asset stored on a Blockchain. Every token stored on the Ethereum Blockchain benefits from the properties of ether itself: distributed verification of transactions, pseudo-anonymity, almost instantaneous and low-fee transfers, censorship-resistance, access to smart contracts etc.

A USD Stable token means mainly two things:

- Crypto-properties are added to dollars. (You have an asset that has the same value as one USD bill but with better properties: you can do much more with it)

- It is now possible to store USD-stable values within the Blockchain with these tokens.

How StabL will offer Stable tokens?

In order to be able to explain the approach, they say they will map and compare StabL tokens with different existing stable assets and their underlying stability mechanisms and properties.

The Spectrum of Stable Assets

A stable asset is something you can own that keeps a stable value against an index. For instance, a gold-stable asset that is worth 500 g of gold today will be worth 500 g of gold for its entire lifetime. There are plenty of different assets that fit this definition. Here is a list of them and an analysis of how they differ from one another:

Assets that represent directly gold.

- 500g of gold buried in a desert.

- 500g of gold ingots.

- 500 g of gold coins in a purse.

- Bank deposit box that contains 500 g of gold

- 500 DGX tokens (Ethereum tokens)

Assets that are valued at a stable gold weight but do not directly represent gold.

- A contract with a friend that states that he owes you 500g of gold, with a set due date that is 6 months from now.

- Gold ETF shares. (SPDR Gold Shares ETF for instance). Shares of a fund which variations follows gold price variations.

- Position in a Contract For Difference (CFD) USD vs Gold (i.e: In 6 months from now, I will buy 500 g of gold at a specific price determined today)

- Gold StabL Tokens bought on StabL platform (Ethereum tokens that represent a position in an on-chain cash settled future contract. We will not focus on Gold StabL tokens in our early stages, but this is a good example to explain our approach)

Every previously listed asset has different properties. Let’s try to compare our listed assets with the most important properties.

Value Storage Property: ownership of your asset and its underlying value.

What guarantees you that the underlying value of your asset will remain?

- How secure is your ownership?

What/Who guarantees you the ownership of your asset will remain? When you store gold yourself (coins, lingots, buried gold), you trust yourself, when you use a bank deposit box, you trust your bank not to be robbed (or to have good insurance), when you use an Ethereum token (StabL, DGX), you trust the Ethereum technology and yourself with the way that you store your private key.

It is difficult to rate these assets against this property since it depends a lot on ourselves. (How do I bury gold? How do I keep my private key? What Bank did I choose? How do I store the written contract I signed with my friend?).

On the long term, we are convinced that owning a token that lives on a Blockchain like Ethereum is the most secure way to own an asset. The Ethereum community is still in the early stage, but mature tools to store and back up private keys along with privacy will make owning tokens seamless yet secure.

Given that your ownership is secure what makes its value guaranteed?

When owning physical gold, there is no risk of your asset losing value (Gold is an amazingly stable element.

When owning physical gold through a proxy (bank deposit box, DGX), you trust this proxy.

When owning a financial asset like Gold ETFs or Gold futures, it is a bit more complicated. The value is guaranteed by the robustness of the game theoretical financial mechanism that includes an ecosystem of traders, arbitragers, hedgers, index providers, laws enforcers etc. You also usually trust the exchange that gives you access to these assets.

StabL aims at leveraging Blockchain technology to replicate the CFD/Futures market mechanisms on-chain, issuing stable tokens backed by a game theoretical mechanism that runs in a trustless fashion. Theses tokens will be distributed through a decentralized exchange.

Transferability: Ability to transfer the asset.

Gold coins are more transferable than lingots or raw gold but still need to be exchanged in the physical world.

Buried gold or gold stored in a deposit box have poor transferability properties.

Ethereum tokens that represent a stable value of gold (DGX or Gold StabL Tokens) are definitely the assets that have the best transferability properties (20 sec on-chain transfers, instant using state channels, low fees, secure).

Liquidity: Ability to trade the asset.

For an asset to be liquid (meaning you can sell/buy a large amount of it quickly), you need it to be available on exchanges that have large volumes. Volume is one of the key factors that relate to velocity. The most liquid assets are positions in CFD/Futures and ETFs. Indeed, since they don’t represent physical gold but positions in a financial system, it is easy to buy/sell them. You don’t need to move any physical good.

New CFD/Future contracts can be created (on the so-called primary markets) as soon as two parties agree on a Future contract. Then these two parties can sell their position in the Future contract (on secondary markets).

In today’s financial world it harder for small investors to trade on the primary market.

With Ethereum and easy digital contracts creations, this market becomes way more accessible: the difference between primary markets and secondary markets are blurred, giving an overall more efficient market.

StabL Tokens have the same mechanical properties: if our on-chain financial products (Futures-like products) attract a large number of traders (a lot of Future contracts created), our tokens (that represent a position in one of these contracts) will be much more liquid than any gold-backed token. If there does not exist enough Future positions that are stable against USD (represented by a USD StabL token), you just create some by being matched with a trader around a Future contract as easily.

Non-financial properties: What else you can do with these assets.

Gold can be used to store value, to transfer value, to wear value, even to lend value as vehicles in contracts. Futures and ETFs have better trading properties since they are well suited for the internet world, yet they rely on centralized parties whereas gold, as a chemical element, relies on, well, physical trustless laws.

On-chain stable tokens open a whole new world to gold. Both DGX and StabL Tokens can be used in smart contracts. For instance, they can be used as a currency in a trustless crowdfunding platform like WeiFund. What is even more powerful with StabL tokens is that since their value is guaranteed by a decentralized game theoretical mechanism (based on Futures market), the only potential point of failure lies in the design or the implementation of the mechanism. Even if we think we have found a design that works in the on-chain world, we are very well aware that offering such a mechanism at all once is near impossible (especially in the current youth of the Ethereum ecosystem) and we differentiate ourselves by taking a lean approach.

Approach and High-Level Roadmap: A lean and experimental approach

We’d like to present our past, and more importantly, the values that brought us together.

The core team behind StabL includes financial engineers, experienced Ethereum-based applications developers and economists. We all share on top of our passion for Blockchain and decentralization a deep conviction that developing lean and pragmatic Ethereum-based ventures as any other, focused on releasing and iterating on products, will help the ecosystem in a synergetic way with theoretically brilliant white papers.

For more than one year, we have, in our bootstrap approach, been supported, advised and challenged by the ConsenSys Mesh. It is time to release our first product (early March) and widen the circle of our collaborators to anybody interested in cryptocurrencies, trading or finance.

For the past year, we have been researching, exploring technological limits, implementing prototypes and leading interviews. Here are the main learnings we have included in StabL’s DNA:

- Ethereum is young, immature and one of the most promising technologies of the century. It makes no sense to use today in its public version as a mature technology. It will be used as an infrastructure for mainstream applications but it cannot today.

- Our main goal is to see a production version of Ethereum (not just its Blockchain) suited for large-scale applications. This includes easy-to-use key managers, web3 providers, decentralized storage, p2p messaging, privacy, Blockchain(s) scalability (off-chain a/o on-chain), dev tools & best practices and of course stable tokens :). I am amazed to see all theses challenges being tackled by our decentralized community at the same time and hope the fruits of our labor will all come together soon!

- Decentralization is the goal but it does not need to be the path. If by being semi-centralized we learn and get to decentralization faster, we should do so proudly.

- The beauty of applications built on Ethereum is not their decentralized infrastructure, but the benefits that come out of it. We will try to prove that by competing with centralized infrastructure products as much as we can.

- We will release simple but robust products with the aim to improve them as fast as we can.

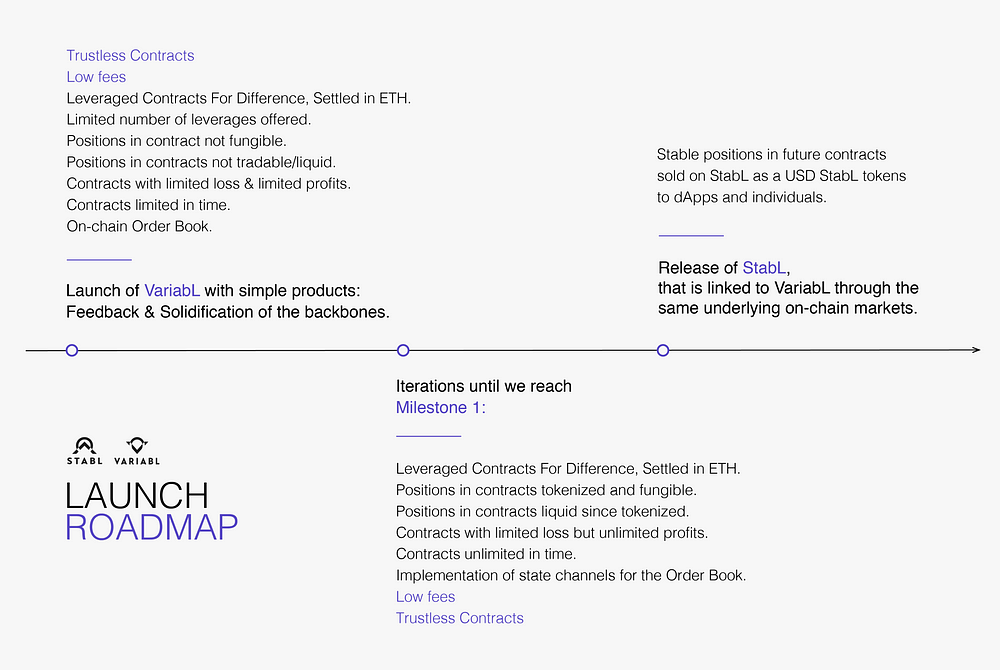

High-Level Roadmap:

There is a general idea that is important to understand when thinking about complex financial ecosystems: they are intertwined networks (very strong network effect). A complex financial system based on free market efficiencies is very scalable and efficient at large scale but very weak at low scale:

- Recovery from a brutal event can be very difficult.

- It is weak against speculative attacks.

The general idea is that kickstarting a complex financial ecosystem which reliability needs a lot of actors and high volume traded between these actors is almost impossible. We think it is possible to start with more simple systems that are robust at low scale, and even if the financial products have limited liquidity, fungibility or life duration properties they remain interesting and benefit from new properties thanks to Blockchain technology. Their properties can improve along with volume attracted on these products.

That way, we can remain robust at every stage and find a path to more scalable products without having to make an (unlikely) all or (likely) nothing bet.

You can reach Hadrien Charlanes for any inquiries at @hcharlanes on twitter.