Overview

Thanks to the rise of cryptocurrency and Blockchain technology, lately there has been a large influx of projects empowering themselves by doing token launches to raise the funding they need to execute their vision, opposed to raising venture capital. Many of these are taking place on the Ethereum protocol.

There used to be only a few raises per month, and now there are some happening every day. Considering how we haven’t seen very functional front end Ethereum projects (until very recently — most in Alpha), I expect this upward trend to continue — especially as more people realize that they have more power to do anything they can dream of than ever before. Overreaching regulatory constraints imposed by any particular country will mainly do a disservice to the government and its citizens, opposed to the people building projects, due to the structure of these distributed networks.

The Bancor Challenge

Over the past few months, I have had the opportunity to dive into The Bancor Protocol. It is one of the platforms that will provide easy access into the Ethereum protocol, and improve the quality of many lives (which, to me, is what Blockchain ultimately is all about).

Some of the underlying mechanics are so abstract (relative to traditional finance) that it has been a struggle to actually explain what this project is due to its complexity (even to people who are supposed to be professionals at the top of their field). The point of this article is to hopefully clear some of that up. So, I’ll give a quick overview of Bancor, and then share a new way to think about the whole thing, which might be accessible to a wider audience.

What is Bancor?

The Bancor Protocol is built on top of Ethereum. On the front end, it provides a clean user interface/experience, similar to a social network, for people to:

- Create community currency tokens on Ethereum

- Perform a crowdsale

- Make token baskets (pools of tokens that are represented by one token)

- Deploy single-party token exchange mechanisms like token changers

…all through a chatbot on Telegram or FB Messenger (I think this is pretty epic).

Now, the backend of the protocol is where things get really unique. Bancor provides each token created on the protocol with unique functionality, which makes them, in Bancor terms “Smart Tokens”. These Smart Tokens are special for a few reasons:

- There is an inherent price discovery mechanism that provides each token with a price without the need for a market to determine its value on an exchange

- Each token has a reserve in its smart contract which allows for a predetermined percentage of liquidity to always be accessible to token holders — this allows people to buy/sell without a party on the other side of a transaction

- The token creator can decide which tokens will be accepted into the contract to build the reserve

- The Bancor Protocol token (the one that is being generated for the upcoming sale) will provide support to other cool smart tokens built on top of the platform

- “Guardian” capabilities, where you can choose trusted friends to back up your wallet in case private keys are lost

So, Bancor could be considered the ultimate liquidity protocol, because all tokens are liquid all the time, no matter how much interest is present on the buy side of an order book. The price of the token rebalances with every block in relation to the amount stored in reserves and the reserve ratios (the price would go down if a bunch of people sold at once, but you’ll at least get something back, unlike other tokens).

Maybe that makes some sense. If not, it’s cool. Again, that’s the point of this article. Let’s start the transition towards a new perspective.

Let’s Talk About Liquidity

Here is a dictionary definition for liquidity:

“The availability of liquid assets in a market or company.From early 17th century: from French liquidité or medieval Latin liquiditas, from Latin liquidus”

Okay, I always learned to not use the word you are defining in the definition, so let’s define liquid assets:

“Assets held in cash or easily converted into cash”

Again still defining part of the word as the definition, but at least more helpful. Let’s replace “cash” with “ETH”, “Assets” with “Ethereum based tokens”, and remove “held in cash”, which leaves us with:

“Ethereum based tokens easily convertible into ETH”

Anyone who trades on exchanges like YoBit, C-CEX, Cryptopia, and sometimes even Polo/Bittrex, has probably experienced the pain of not being able to exchange their position back into a base currency (like BTC or ETH) at the right moment. It’s unfortunate when there are moon-bound opportunities presenting themselves, and you can’t go along for the ride.

Maybe if you aren’t a crypto trader you’ve tried to sell a house, a piece of art, or a ticket to a music festival, but at that time there is no market for what you are selling. Until you find a buyer, you are stuck with that thing. Bancor eliminates this issue. As previously mentioned, you don’t need a second party to execute the transaction due to the reserve and price discovery algorithms.

Matter and Smart Token States

A close friend was reading up on Bancor and came to the conclusion that Bancor is hard to describe, and that the mantra must be:

“Simplification. Simplification. Simplification.”

I totally agree. A good ELI5 (Explain Like I’m 5) is crucial to any abstract monetary frameworks proposed in this emerging paradigm.

He also proposed a unique way to think about Bancor, and the “states” of what goes on inside the protocol at a high level. I had to let what he said sit for some time before really understanding how interesting of a lexicon it actually provides.

Let’s start with matter. What’s matter?

“Physical substance in general, as distinct from mind and spirit;

In physics it is that which occupies space and possesses rest mass, especially as distinct from energy

– From Latin mater — mother”

Matter and mater have a lot of correlations.

The Three States + Chaos

Matter generally has three states. Let’s take something we all know about — H2O. It’s a drink. It makes other drinks cold. It produces steam. Sometimes you can swim in it. It’s essential to life. H2O has three states, which most of us probably remember from elementary school and experience regularly:

- Solid : Ice

- Liquid : Water

- Gas : Steam

We are going to apply these states of matter to Bancor Smart Token functionality, but first here are some things the dictionary and I think of when contemplating these states:

Solid

- Storage. Foundation. Base. Stable.

- “Firm and stable in shape; dependable; reliable”

- Changes into liquid upon heating

- Late Middle English: from Latin solidus; related to salvus ‘safe’ and sollus ‘entire.’

Liquid

- Adaptable. Modular. Flowing. Efficient.

- “A substance that flows freely but is of constant volume”

- Changes into gas upon heating and solid upon cooling

- Allows everything to flow smoothly and efficiently. Mobile and functional.

- Late Middle English: from Latin liquidus, from liquere ‘be liquid.’

Gas

- Airy. Etheric. Adventurous. Expanding.

- “An air-like substance which expands freely to fill any space available, irrespective of its quantity”

- Changes into liquid state upon cooling

- Origin — “mid 17th century: invented by J. B. van Helmont (1577–1644), Belgian chemist, to denote an occult principle that he believed to exist in all matter; suggested by Greek khaos ‘chaos’, with Dutch g representing Greek kh.”

Let’s define chaos. It will be helpful as we proceed:

Complete disorder and confusion

Behavior so unpredictable as to appear random, owing to great sensitivity to small changes in conditions.

The formless matter supposed to have existed before the creation of the universe.

Greek Mythology the first created being, from which came the primeval deities Gaia, Tartarus, Erebus, and Nyx.”

Using the chaotic origins of gas, and focusing on the bolded definition, we can say that solid would be the least chaotic state, with liquid somewhere in the middle.

Linking States To Smart Tokens

So now we have an interesting lexicon that everyone can relate to. Next we can apply this to Smart Token states:

- Solid — Since solid is the most stable, I think it would be fair to say that in the Bancor Protocol, the portion most closely related to ice, or solids, would be the tokens in the reserve. This foundation is what (partially) justifies/prices the value of the Smart Tokens, and ensures that they actually have inherent value. So, the higher the reserve ratio, the more “solid” the Smart Token is.

- Liquid — The tradable Smart Tokens themselves must be the water state. They are what allows this system of value to be tradable and move between parties. So, the number of tokens currently in existence expresses how “liquid” that Smart Token is. “How much water is in the pool?”

- Gas — When molecules are in their gaseous state, they enter and fill empty space. To me, this is the point of a new business or a token launch. There is (or should be) a need (or space) for a particular thing. So the gaseous state is linked to the funds in a Bancor Smart Token when a crowdsale happens that is not stored in the reserve. We could in a sense call it the “venture capital” because it will venture out to fill the space. This would include an operating budget, cover expenses, marketing, and other items until a project can be completely sustained by its revenues or community.

Liquidity vs. Fluidity

So we’ve already addressed liquidity, and understand how Bancor inherently creates a lot of it. Now that we have also broken down the forms of money that comprise the whole of a Smart Token through this new lexicon, I want to introduce a new term that expresses the overall utility of Bancor’s Smart Tokens in a functional way.

Fluidity:

The ability of a substance to flow easily – Smooth elegance or grace

The thing that most interests me about this protocol is the utility of currency once it is in a Smart Token contract. It is hyper-functional and serves multiple purposes in the different states at the same time. The currency can also move between states very efficiently. This, to me, is flow. It’s fluid. Reserves don’t inhibit, but support growth. Active capital raised through a sale isn’t a liability, but fuel. The tokens make value transfer seamless and unobtrusive.

So, this is why it seems that, to me, Bancor is more than just a liquidity protocol, but more accurately a fluidity protocol. Seamless transitions between states allows for gas to turn into solids, or operations to turn into reserves during times of uncertainty or stability at the click of a button (or message to a bot). When many new users are coming in, new Smart Tokens are generated at a higher rate, which increases both the reserves and operating capital. The Smart Tokens themselves let the community continue to function, and provide a representation for who owns how much.

Unlike storing funds in a bank account, taking out loans, and “trusting” bodies like the FDIC, the power is completely in the hands of the people in the network.

Example Part 1

We are going to create a community currency that supports the building of an endless chain of yoga studios (but like yoga for serious people, not the stuff happening in the West these days). We need a minimum of 250 ETH to get the first one going. Ideally we want 500 ETH so we can get the really good sound system, cushions, flooring, etc., but we can do well with less.

So, we go onto Bancor and spin up the chat bot. We say that we want YogaCoin. It will emit at 100 YOGA per ETH. The reserve ratio will be 25%. Our crowdsale will be promoted for 30 days, but tokens can be generated forever to support the development of new studios. Paying for classes in YOGA will give you discounts at classes and special token holder perks. There are also super secret bonus features for those who hold over 5,000 YOGA, but no one knows what they are until an undisclosed time in the future (we are hoping that suspense and uncertainty will interest people to buy a lot).

-30 days later-

As good fortune would have it, we raised exactly 500 ETH in the 30 day period. People seemed pretty stoked about the super secret perks (which now everyone knows is a heavily discounted trip to Costa Rica to surf and drink coconuts).

Analysis Part 1

So far we have:

- Reserve of 25% (125 ETH) : Solid

- 50,000 YOGA : Liquid

- Operating Budget of 75% (375 ETH) : Gas

- This would price our token at 0.01 ETH per YOGA (based on calculations from the white paper)

What we are deciding here is that, essentially, the token’s value is equivalent to 500 ETH even though there is only 125 ETH in reserve? So that basically prices the token at 4x its holdings. That means we now have 375 ETH for operations and the full value of the token. Relative the speculative value of some ERC20 tokens on the market right now, 4x is quite reasonable and in line with future potential.

The Balancing Act

Remember Goldilocks and the three bears? Well, this is one way to think about Bancor project maintenance.

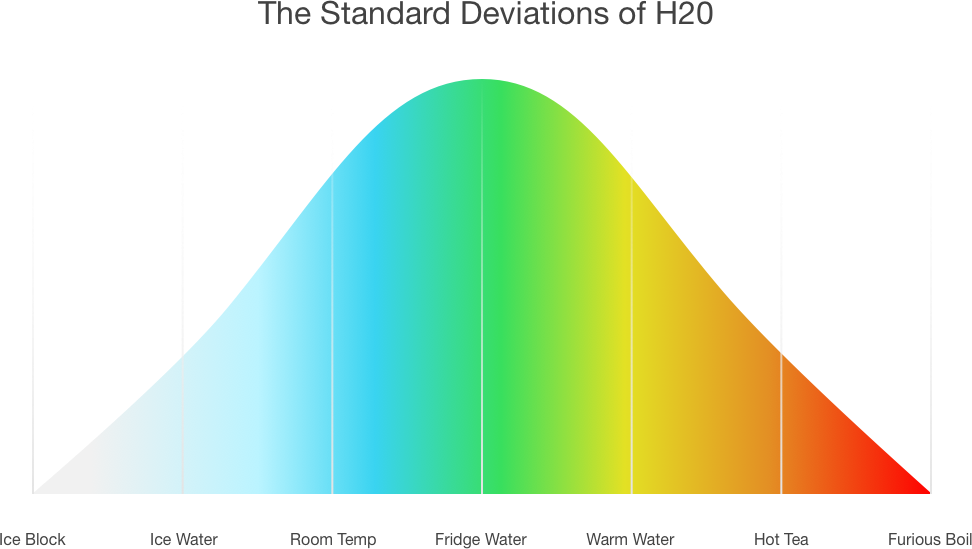

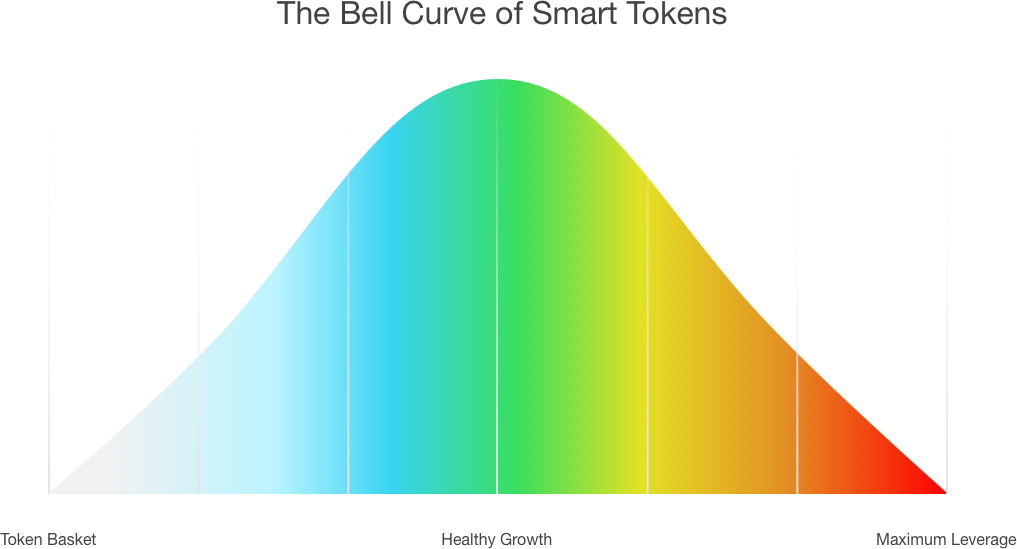

Depending on the use case, we have to continuously make the composition of solid, liquid, and gas just right. It’s like if I want to drink a glass of water, I’m not going to get just a block of ice. I’m also not going to sip on furiously boiling liquid (or a glass of steam). I’ll probably find myself somewhere in the middle with a nice around room temperature glass of liquid water. Sometimes I’ll drink tea and other times I’ll have ice water, but it’s rare to be more than 2 standard deviations away from the median.

The same thing goes for Bancor Smart Tokens. Although cold and hot is still a perfectly workable analogy (because atoms compress/solidify when cold and expand/gasify(?) when hot), let’s instead use conservation and growth phases to break down this part.

In the initial phase of a project released on Bancor (or just in general), the goal is to fill the need quickly and effectively. To do this on Bancor, you would limit the reserve to a lower percentage and utilize more of the capital in the gaseous state. The volatility would be

higher every time a transaction takes place, but the extra operating expenses would more than compensate for that volatility.

Once a project has started to gain traction, it might make sense to raise the reserve ratio, to better stabilize the price and continue growth at a sustainable rate. Liquidity would be higher for Smart Token holders, and less pressure to continue exponential rates of growth. Most projects would never go past 2.5 standard deviations on either side to ensure both some liquidity and capital to grow.

Example Part 2

Our yoga studio has been operating smoothly and we have expanded to 108 locations around the globe. We have partnered with some of the top yoga props and clothing manufacturers to offer deals when utilizing YOGA token as the medium for purchase. We feel that 108 yoga studios is a healthy number and decide to slow our rates of expansion.

There are two functions that to do here:

- Start funneling a portion of revenue into the contract to increase the supply of liquidity and currency

- Raise the CRR to ensure that any currency deployed is much more stable.

These two items provide a security web for YOGA users, ensuring that even if a significant amount of tokens are sent back into the contract, it will not affect the price as drastically. Once a healthy equilibrium is reached, the dynamics of the economy are solidified and we could say that this particular economy has crystallized a fundamental layer of support and validity in relation to other communities.

Conclusion

This is really only one iteration about how the Bancor Protocol will be useful. There are many others. As protocols to ease participation within the crypto economy come to the forefront, there will be a huge wave of digital tokens created by a range of users who may or may not be equipped to sustain a community currency (or other similar token). Through its unique price discovery algorithms and simple user interface, The Bancor Protocol provides not only the accessibility but also a layer of safety via its continuous liquidity mechanism.

On top of the functional layer, it is exciting how rapidly some of the philosophy proposed by incredible thinkers of the past 100 years can be rapidly deployed through Ethereum implementation. Bancor is one of the first, directly tapping into John Maynard Keynes proposal from the Bretton Woods conference. The non-obligatory participation is an additionally beneficial element provided to us by this emerging paradigm.

My Relationship With Bancor

I met part of the Bancor team in February 2017 at CoinAgenda in Puerto Rico. I was instantly drawn into the project and started to develop a relationship with the team. I read up on all of the information Bancor released and stayed in contact. Eventually, I got somewhat knowledgeable about the project and started writing on a piece with Smith and Crown about the Bancor launch. During this time I connected even further with the team, and we decided to work together (which meant that I couldn’t officially review the sale through a Smith and Crown lens). In the few days leading up to the launch, I have had the privilege of working with the team out of their office in Tel Aviv. They are one of the most dedicated groups I have had the pleasure of working with in the cryptospace and I can’t wait to see the meaningful impact this project will create.

Thanks to Itay Dreyfus of the Bancor team for assistance on the graphics!