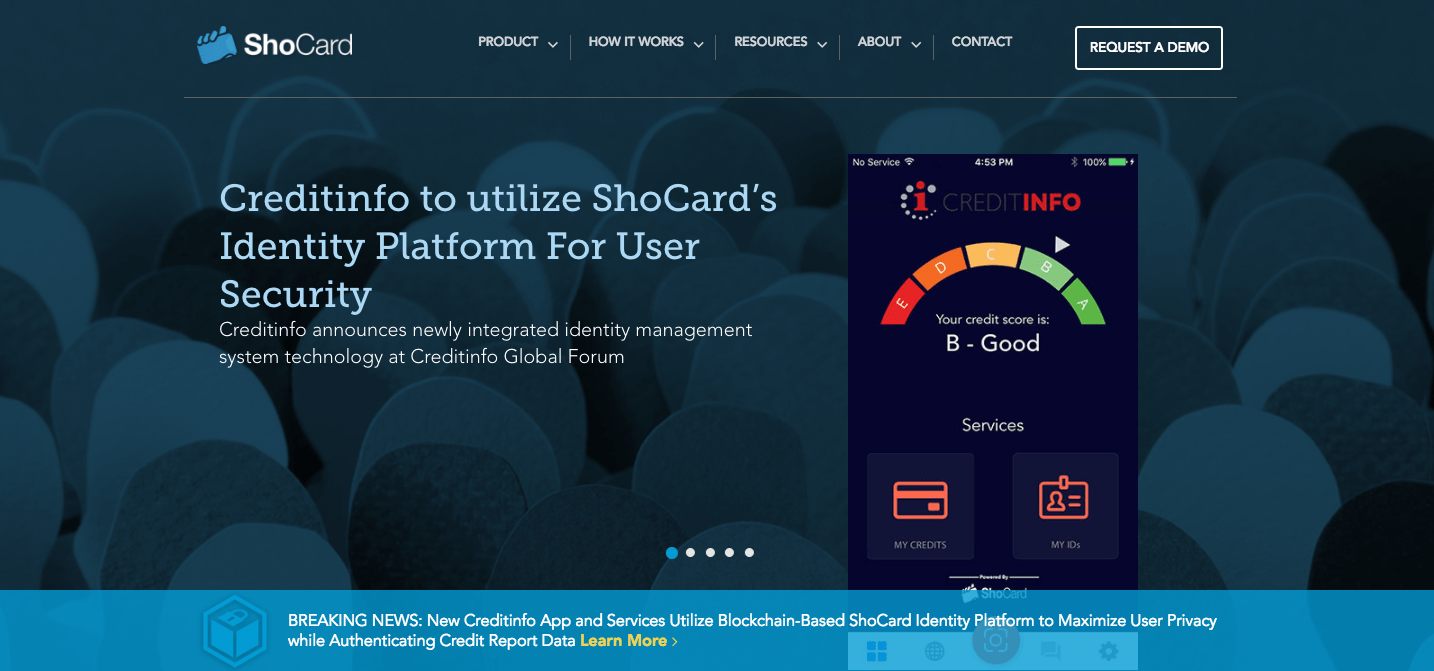

ShoCard, a leading Blockchain-based identity management system (IMS), together with Creditinfo, a leading service provider for credit information and risk management solutions worldwide, today announce the ShoCard IMS’s integration into the new Creditinfo app.

The app enables individuals to claim their identity and obtain personal credit information that can be shared with any third party, as well as be independently verified with proof of certification using the Blockchain.

By integrating the ShoCard Identity Platform, Creditinfo enables consumers to share their credit information with financial institutions across borders, without the need to centrally access or manage this data that could otherwise violate country-based privacy protection laws. Furthermore, the consumer data is not centrally stored and replicated through this system, hence eliminating hacking vulnerabilities.

“The Equifax hack, alongside continued data breaches of PII across industries, has demonstrated a need for a new solution to protect consumers’ and clients’ most sensitive data,” said Alexander Novoselov, Head of FinTech Innovation at Creditinfo. “By incorporating ShoCard’s Blockchain-based technology, PII data stays with the user, and is verified using the Blockchain, thereby giving our users the most control over their information as possible and eliminating large databases of credit scores and other private information, a critical target for hackers.”

The initial setup and registration process for Creditinfo customers is simple. Once the Creditinfo app is downloaded, the user is asked to take a photo of their passport, provide their identification credentials with Creditinfo, and save their information to create a validation record on the Blockchain for the user. Once the user’s identity is verified, signed and encrypted, credit score data will be passed to the consumer through the app, where it is also independently hashed, signed and certified on the Blockchain by Creditinfo to verify the authenticity of the credit information passed to the user. The app will decrypt the data for the user’s viewing, and the user then has the option to share this information with other users or services using either a QR code or Bluetooth exchange.

“At ShoCard, we believe Blockchain technology provides the next evolution of identity management for consumers and enterprises, and we’ve built our solutions to utilize the Blockchain as an immutable ledger, never storing PII in our services,” said Armin Ebrahimi, CEO and founder at ShoCard. “It is our vision to eliminate legacy vulnerabilities that expose data to hackers, while removing friction to better enable data sharing between different entities like consumers, banks and credit information providers, bringing peace of mind to consumers and the shareholders of these organizations.”

Ebrahimi will be presenting at Creditinfo Global Forum on Wednesday, Sept. 20, 2017 to speak about ShoCard and how Blockchain technology is revolutionizing identity management.

For more information on ShoCard’s solutions, visit www.shocard.com.