Decentralized trading technology startup Vega, has collected a strategic seed raise of more than $5 million, led by Pantera Capital. The funds will be used to facilitate the transition to more inclusive capital markets through investments in decentralized finance.

“In Vega, we see a project with the potential to disrupt and transform the financial landscape with decentralized margined products. The team’s vision for the future of finance is a level playing field in which all people can participate. That vision is integral to the blockchain ethos and represents everything we are fighting to enact,” said Paul Veradittakit, Partner at Pantera Capital.

Vega’s protocol design can restructure the trillions of dollars per day derivatives markets to run automatically over peer-to-peer networks with investment bank-grade risk management processes.

Barney Mannerings, founder and shareholder of Vega Holdings Limited, added:

“We support the right to collaborate and trade freely. Privileged institutions and gatekeepers have for too long kept the financial system rigid and rigged in their favour. It is neither desirable nor necessary for market participants to be subject to profiteering, monitoring, and control by those privileged institutions.”

The global group of strategically chosen backers also includes Xpring (Ripple), Hashed, NGC Ventures, Gumi Cryptos Capital, Rockaway Blockchain, KR1, Eden Block, Focus Labs, Greenfield One, Monday Capital and RSK Ecosystem Fund.

Vega has an ambitious goal to design and implement a protocol for safe and non-custodial decentralized margin trading. With Vega’s software, traders can operate and participate in peer-to-peer markets that guarantee open access, transparent rules, and the freedom to innovate. Vega’s decentralized nature eliminates the rent-seeking middlemen endemic to traditional capital markets and enables global access to financial tools.

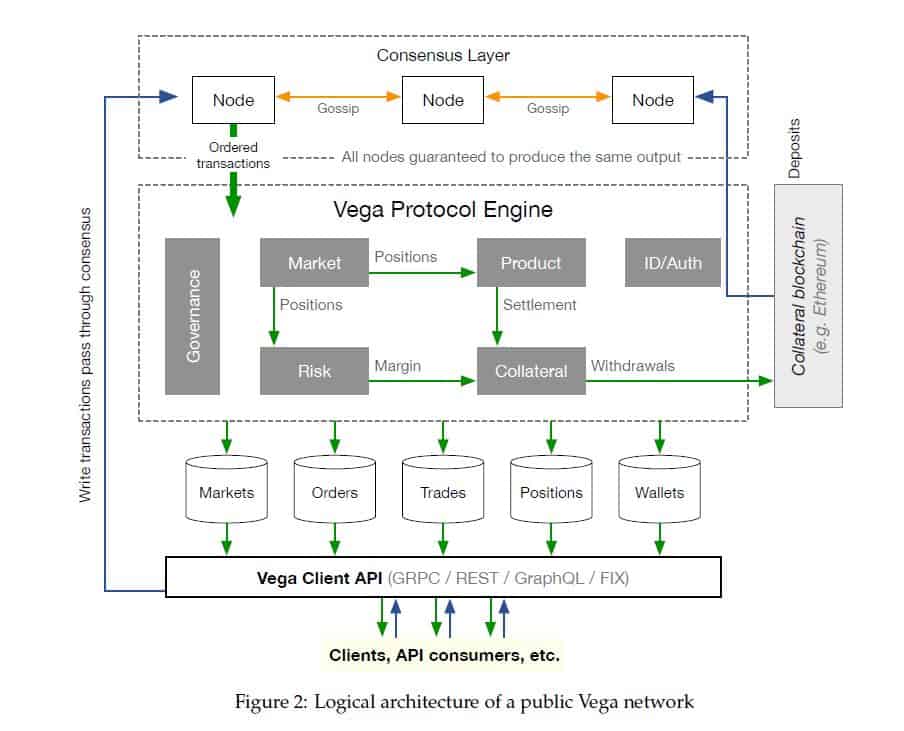

Vega is a layer-2 solution designed to avoid the performance and market fairness problems associated with decentralized markets built on layer-1 blockchains like Ethereum or Bitcoin.

More key innovations include:

- a fully automated end-to-end trading system that dramatically cuts operational overheads versus traditional trading operations

- a protocol that incentivizes market creators and market makers with significant rewards from fees paid by other participants for launching liquid markets

- a bespoke sidechain optimized for trading, with 10-100x faster execution than similar protocols on general-purpose blockchains

- a framework for creating and customizing products that give every participant the freedom to build new financial instruments and markets

With significant experience spanning trading, market infrastructure, cryptography, blockchain, software engineering, strategy, and business development, the Vega team is uniquely positioned to spur the growth of the nascent decentralized trading ecosystem.

At present, Vega is focused on completing and testing the first version of the core protocol. The team is also launching community-focused initiatives to engage developers, traders, and ecosystem partners. The first private test network demonstrating margin trading with test assets is expected to launch imminently and expand into a publicly available testnet soon after.

Vega is a technology protocol and associated crypto-asset for an open, blockchain-backed public network for fully automated end-to-end trading and execution of financial products. The network is secured with proof of stake and implements pseudonymous margin trading using a novel liquidity incentivisation scheme based on market forces to solve the problem of attracting and allocating market-making resources in a decentralised system.

Permissionless innovation is enabled by smart products that allow anyone to create products and propose new markets. This works in tandem with a decentralised margin system using a suite of risk models based on coherent risk measures to enable the safe trading of arbitrarily complex instruments in an environment with zero expected recoveries in the event of default.

Products can reference practically any underlying price or other data feed, allowing participants to define and trade a wide range of instruments across the full spectrum of global markets. Cross-chain settlement means that the protocol is blockchain agnostic and allows trades to settle in any crypto-asset residing on a supported chain, paving the way for physically settled in addition to cash-settled products, as commodity and asset tokenisation become widespread.

Their protocol allows for traders, market makers, and node operators to interact and to collectively run high performance, fully decentralised markets in a deterministic way without the need for human intervention. This includes a robust market framework which manages the network, markets, and participants, and provides a strong foundation for the functionality of Vega. The protocol covers end-to-end trading including price determination, margining, and settlement, as well as collateral management and on-chain market governance.

Their protocol allows for traders, market makers, and node operators to interact and to collectively run high performance, fully decentralised markets in a deterministic way without the need for human intervention. This includes a robust market framework which manages the network, markets, and participants, and provides a strong foundation for the functionality of Vega. The protocol covers end-to-end trading including price determination, margining, and settlement, as well as collateral management and on-chain market governance.

The Protocol paper can be found here. And the technical overview here.

Over the coming months, Vega will share more details about the protocol’s validator and staking model, its market-making incentives, and the APIs that will be available to traders. These features ensure security, reward participants who create markets and provide liquidity and enable developers to build the Vega ecosystem.

Additionally, the Vega team will publish their research on decentralized market fairness and trading-optimized consensus protocols. They will also attend key conferences and events around the world and host a series of Vega meetups and round tables. Anyone interested in attending or learning more can keep up to date by following Vega on Twitter. Join the discussion and find out about upcoming events in their forums at community.vega.xyz.

Join the Vega Community for an AMA with members of the founding team on Friday, 4th October at 16.00 UTC+1 at https://community.vega.xyz/t/ama-founding-team/45

Vega is building tools that guarantee the freedom to trade and make capital markets available to everyone. This vision will be realized through a protocol for creating and trading derivatives on a fully decentralized network. Traders can use the Vega protocol pseudonymously and be rewarded by other participants for creating new products and providing liquidity.