Recent months were rather positive for the global economy as inflation finally started decreasing and investors could finally start envisioning the end of the current rate hike cycle. Both stock and crypto markets felt the positive sentiment with all S&P 500 (18%), BTC (80%) and ETH (55%) rising on a year-to-date basis.

While S&P 500 has had strong gains since the beginning of 2023, ETH gained almost three times as much percentage wise for the same period. We believe the main reason behind that is the Shanghai Upgrade which has been one of the most significant events in the crypto world thus far in 2023. Released on April 12, 2023 it provided Ethereum investors, willing to stake their ETH, great liquidity options by enabling withdrawal of the staked coins or just the accumulated reward.

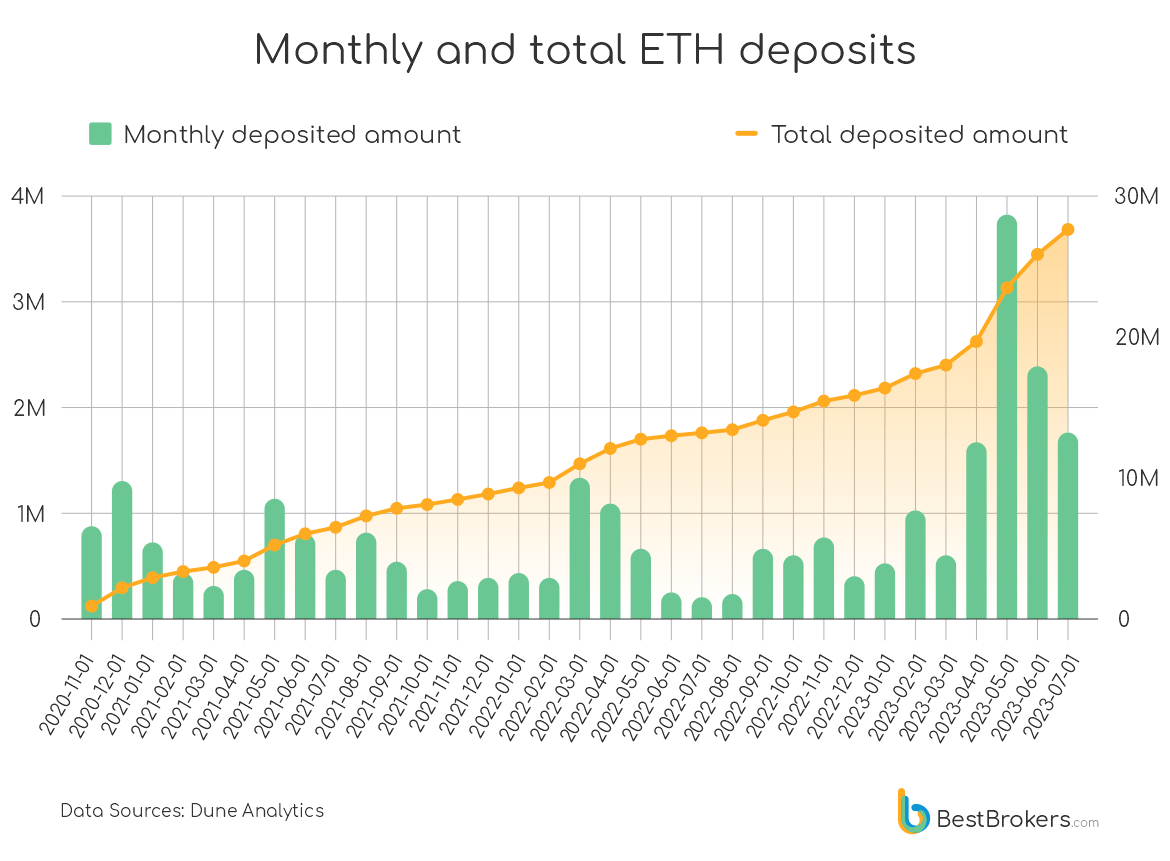

On the cusp of the 4 month anniversary since the Shanghai Upgrade the BestBrokers team wanted to see how this last update to the Ethereum blockchain affected staking, which has been available since November 2020. We pulled some raw blockchain data, using Dune Analytics and plotted the data to find, that the four months since the upgrade have brought record ETH deposits, namely 36% of all Ether ever staked since November 2020:

“Over one third or 36% of the total staked Ether came after the Shanghai Upgrade. It provided an enormous boost in investors’ trust as now they can not only stake and wait but also initiate either a Partial Withdrawal of just the interest at the current 4.3% APR or a Full Withdrawal of all staked ETH plus the rewards. After both BTC and ETH rebounded from the market lows in December 2022, the Shanghai Upgrade proved to be a catalyst for further gains which remained relatively stable for an “extensive” period in crypto terms. The Fed’s monetary policy will surely keep affecting both Fiat and Crypto markets, but the Shanghai upgrade definitely was a step towards making crypto markets safer for investors.”

– comments Alan Goldberg, analyst at BestBrokers.

The great ETH staking activity

It has been less than 4 months since the release of the Shanghai Upgrade and over 10 million ETH have already been staked. This is in stark contrast with the monthly staking rate before the upgrade, as it took 29 months for the remaining 18 million Ether to be staked prior to the upgrade. When we compare 9.8 million over a 4 month period to 18 million over a 29 month period this gives us a 4-fold increase in the average staked Ether on a monthly basis before and after the upgrade.

While the ETH price surged to over $2,100 right after the upgrade and reached a low point of $1,650 in June, it remained quite stable for the most part of this period in the range of $1,800-$1,900. Such low volatility is quite unusual for the crypto markets overall but it also is a sign that Ethereum is becoming more of a commodity and less of a speculative asset.